After weeks of steady decline, SEI seems to be stabilizing around a historically important price zone. But don't mistake stability for strength—the current setup offers little indication of an imminent bullish reversal. While there have been small intraday gains, weak volume and a lack of catalysts suggest the market is still sitting on the fence.

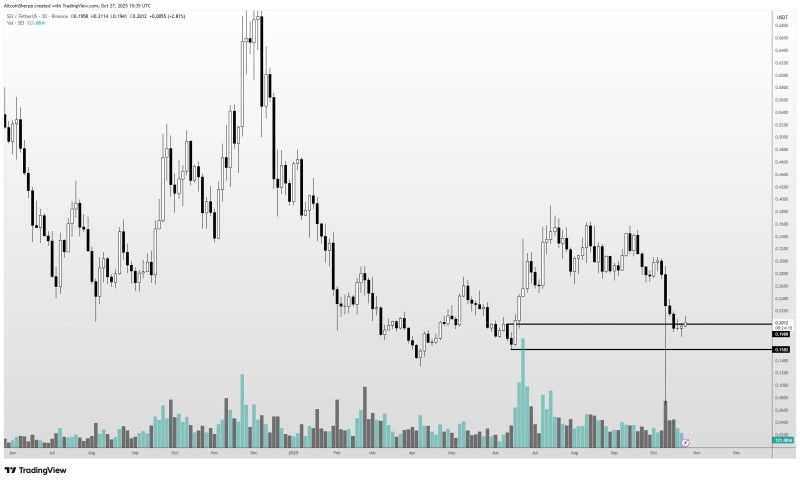

Chart Analysis: Holding Ground Near $0.20

Analyst Altcoin Sherpa's recent take captures the mood: SEI is technically holding support, but it's missing the spark or narrative needed to stand out from the pack right now.

Looking at the SEI/USDT chart on Binance (3-day timeframe), you can see a prolonged downtrend that's flattened out around the $0.20–$0.21 range. This zone has acted as a safety net multiple times this year, catching the price on several occasions—but each bounce has been weaker than the last.

Key technical levels:

- Support: $0.158 — a solid accumulation zone from June and October, backed by notable volume spikes

- Current price: ~$0.2012 (+2.8% daily) — sitting just above support but without any convincing breakout

- Resistance: Around $0.26, matching the lower high from September

- Volume: Stronger during past dips but fading recently, signaling buyer hesitation

The price is stuck in a low-volatility box. That means downside risk may be limited for now, but upside potential is also capped until fresh money flows in.

Technical Outlook: Neutral to Bearish

Structurally, SEI looks like a classic range-bound asset—bouncing between clear horizontal levels without much conviction. There's no real follow-through above $0.25, which tells you buyers aren't ready to commit yet.

Unless SEI can reclaim the $0.26–$0.28 zone, the path of least resistance remains sideways or slightly down toward $0.16–$0.18. A clean break below that support could invalidate the current base and trigger a deeper pullback.

SEI's lackluster performance reflects what's happening across many mid-cap altcoins. With no major upgrades, exchange listings, or ecosystem news recently, price action has been purely reactive—mostly following Bitcoin's lead.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets