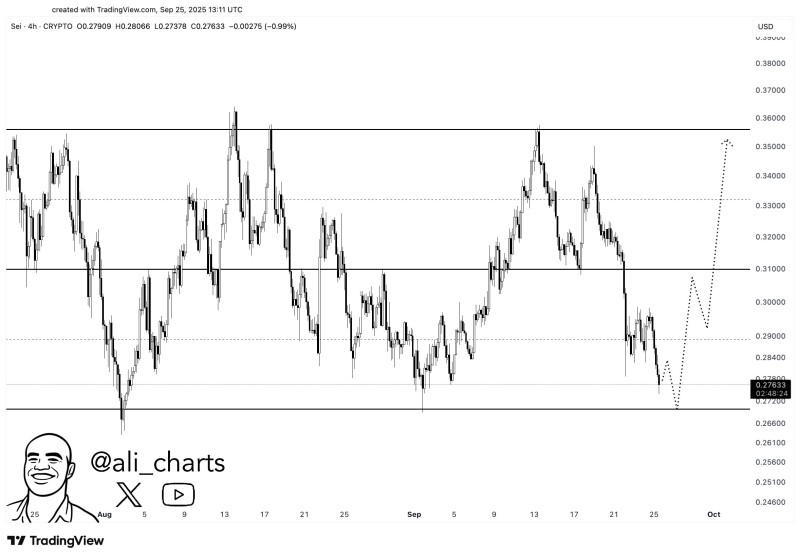

SEI has reached that moment every trader knows - the make or break point. After multiple failed attempts to stick above $0.30, the token has fallen back to test the $0.27 support zone once again. This isn't just another price level - it's been the main battlefield between buyers and sellers for weeks.

What's Happening Right Now

As Ali points out, if SEI can defend this line, we could see a solid bounce toward $0.34. But if it cracks, things could get messy fast.

The $0.27 zone is where SEI keeps finding its footing, but each test makes it weaker. A clean break below this level opens the door to $0.25, and nobody wants to see that. On the flip side, if buyers show up here like they have before, the path to recovery looks pretty clear. First stop would be $0.31, then the main target at $0.34 where previous swing highs created strong resistance. Push past that, and $0.36 becomes the next logical target.

SEI's current struggles aren't happening in a vacuum. The entire crypto market is walking on eggshells right now, with macro uncertainty keeping everyone nervous. But here's the thing about altcoins with well-defined ranges like SEI - when they defend key support levels, the bounces can be explosive. Traders love these setups because they offer clear risk-reward scenarios.

Key Levels to Watch

The roadmap is simple but crucial:

- Critical Support: $0.27 - This is the line in the sand

- First Target: $0.31 - Initial resistance on any bounce

- Main Target: $0.34 - The level bulls are really eyeing

- Extended Target: $0.36 - If momentum really kicks in

- Breakdown Level: $0.25 - Where things get ugly

Right now, it all comes down to whether $0.27 can hold one more time. If it does, SEI could turn this latest pullback into a launching pad for a solid rebound. If it fails, we're looking at deeper losses and a much longer wait for recovery. Either way, this level is going to tell us everything we need to know about SEI's next move.

Usman Salis

Usman Salis

Usman Salis

Usman Salis