Ripple's stablecoin RLUSD has achieved the highest volume-to-TVL ratio at 39.49%, surpassing competitors like Tether (USDT), USDC, and PayPalUSD.

RLUSD Demonstrates Superior Capital Efficiency Among Stablecoins

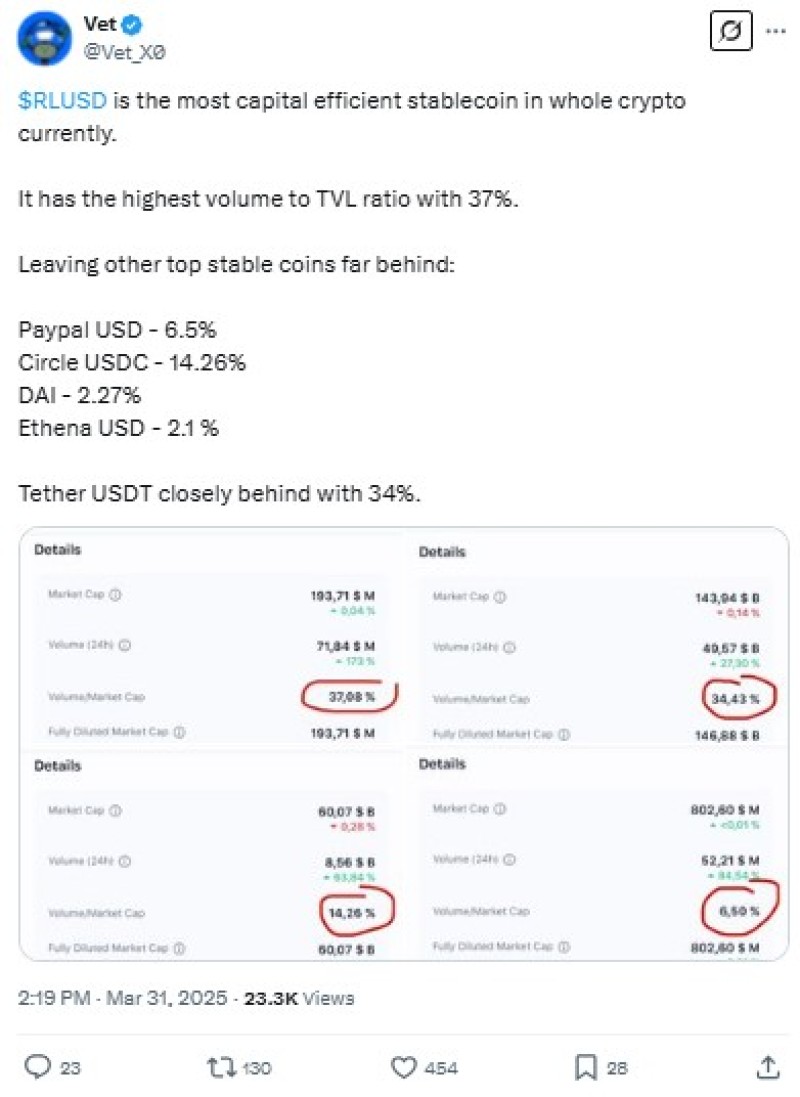

An XRPL dUNL validator known as Vet recently highlighted Ripple USD (RLUSD) stablecoin's remarkable performance in the crypto market. According to Vet's tweet, "RLUSD is the most capital-efficient stablecoin in the entire crypto market currently. It has the highest volume-to-TVL ratio at 37%. Leaving the other top stablecoins far behind."

CoinMarketCap data confirms this assertion, showing RLUSD with an impressive 39.49% on the volume/market cap (24-hour) index. This significantly outperforms other major stablecoins in the market, with Tether reporting 36.45%, USDC at 15.02%, and PayPalUSD trailing at just 6.76%.

RLUSD Market Cap Surges Beyond Internal Projections

Since its launch in December 2024, RLUSD's market capitalization has grown substantially, now exceeding $193.67 million. This growth has outpaced internal projections according to Ripple executive Jack McDonald, who revealed that the Ripple team generally expected RLUSD to become one of the top five stablecoins by the end of the year.

This prediction aligns with statements made earlier this month by Ripple CEO Brad Garlinghouse, indicating the company's confidence in RLUSD's trajectory and market position. The stablecoin's rapid ascent suggests that Ripple's strategic positioning in the stablecoin sector is bearing fruit faster than anticipated.

RLUSD Trading Volume Skyrockets 220% Amid Market Volatility

In a remarkable development, RLUSD has experienced a dramatic 220% increase in trading volumes over the past 24 hours, reaching $81.2 million according to CoinMarketCap data. This surge occurs against a backdrop of broader cryptocurrency market volatility, highlighting growing interest in Ripple's stablecoin despite challenging market conditions.

While RLUSD flourishes, many other crypto assets have recorded losses. Bitcoin dropped 1.81% in the previous 24 hours, trading at $81,985 in early Monday trading. XRP and Cardano's ADA experienced even steeper declines, falling more than 7% during the same period. Other major cryptocurrencies also struggled, with Solana's SOL, Dogecoin (DOGE), and Ether (ETH) all dropping between 2% and 3%.

The Strategic Role of RLUSD in the Stablecoin Ecosystem

Stablecoins like RLUSD serve a critical function in the cryptocurrency ecosystem. They aim to maintain a one-to-one value with less volatile assets, typically the US dollar, providing traders with a reliable means to enter and exit positions in the volatile crypto market.

Beyond trading utility, stablecoins have become increasingly valuable for businesses engaged in cross-border transactions. They enable faster and more cost-effective digital payments compared to traditional banking systems, eliminating intermediaries and reducing fees.

RLUSD's exceptional performance in volume-to-TVL ratio suggests it's gaining particular traction among active traders who value efficient capital deployment. This efficiency metric indicates that RLUSD is achieving substantial trading volume relative to its total market capitalization, demonstrating strong market adoption and utility.

As the stablecoin market continues to evolve, RLUSD's efficiency advantage could position it favorably for continued growth, especially if it maintains its capital efficiency edge while expanding its market capitalization further.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah