Ripple Labs is making a major bet on XRP's future. Bloomberg reports the company is spearheading a $1 billion fundraising effort through a special-purpose acquisition company (SPAC). The funds will establish a new digital asset fund, with a substantial portion dedicated to buying XRP. Ripple plans to contribute some of its own XRP holdings to the initiative as well.

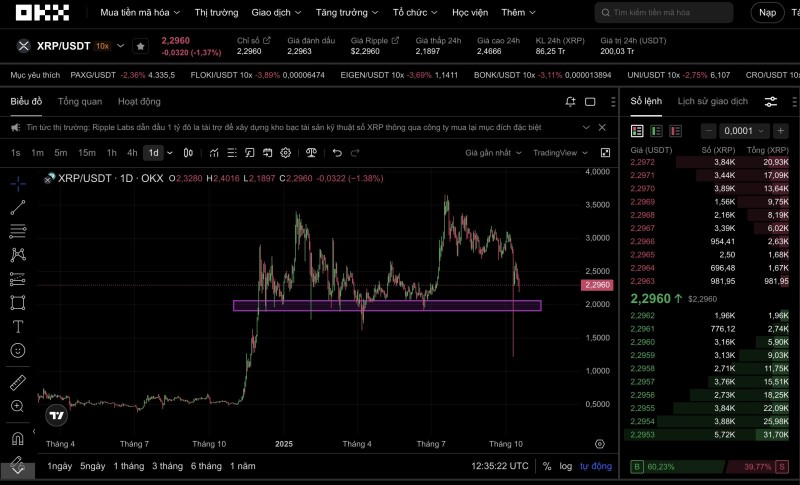

XRP Chart Analysis: Testing Critical Support

As highlighted by NHAT HUY, this aggressive move shows Ripple's commitment to strengthening XRP's position in global finance, even as current prices challenge investor sentiment.

The XRP/USDT daily chart reveals several key points:

- Support Zone: XRP is trading near $2.20–$2.30, a critical level that's been tested multiple times in 2025

- Volatility Spike: A sharp selloff briefly sent XRP under $2.00 before bouncing back, indicating stop-loss triggers and market stress

- Resistance Levels: On the upside, $2.50 and $2.90 remain tough barriers for any recovery attempt

- Trend Context: After hitting above $4 earlier this year, XRP is correcting. Holding current support is crucial to prevent further downside

Why Ripple Is Raising $1B

Ripple's fundraising push serves multiple purposes. The SPAC structure channels institutional money into the ecosystem, improving liquidity and market presence. By committing both external capital and its own XRP reserves, Ripple is putting its money where its mouth is. This matters especially now, as stablecoins and central bank digital currencies compete for market share. Ripple is positioning XRP as a bridge asset for cross-border payments and liquidity solutions. The fundraising also sends a clear message to investors and institutions that Ripple is serious about scaling its network.

Usman Salis

Usman Salis

Usman Salis

Usman Salis