Pudgy Penguins' governance token, PENGU, experienced a significant price rally following the first-ever ETF application to include both cryptocurrency and NFT holdings.

Canary Capital Proposes First-Ever NFT-Holding PENGU ETF

Asset management company Canary Capital has made a historic move by officially filing an Exchange-Traded Fund (ETF) application with the Securities and Exchange Commission (SEC) for PENGU, the governance token of Pudgy Penguins, a popular Non-Fungible Token (NFT) project. The application, submitted on March 20, 2025, outlines plans to hold both the Spot PENGU token and the Pudgy Penguins NFTs themselves within the fund structure.

If approved by regulators, this pioneering approach would establish the first US-based ETF to include NFT holdings, creating a regulated pathway for institutional investors to gain exposure to this emerging digital asset class. The proposal represents a significant milestone in the evolution of cryptocurrency and NFT investment vehicles, potentially bridging the gap between traditional finance and the digital collectibles market.

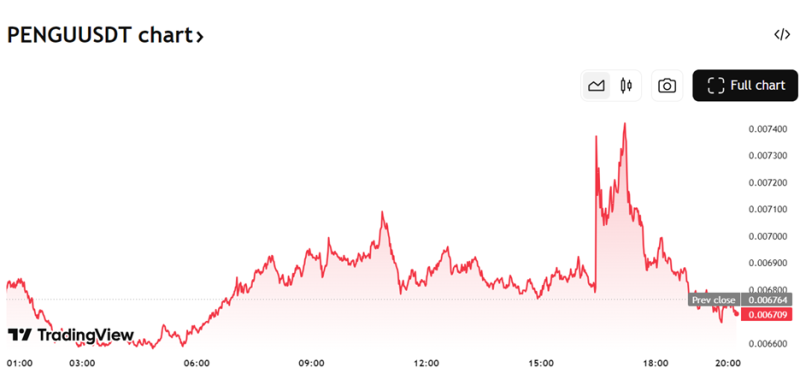

PENGU Market Response Demonstrates Strong Initial Enthusiasm

Following the announcement of the ETF application, the PENGU token experienced a substantial price surge, with trading volumes dramatically increasing across major cryptocurrency exchanges. This immediate market response highlighted strong initial investor enthusiasm for the potential ETF. However, these gains were subsequently erased as the broader cryptocurrency market continued its downturn, demonstrating the ongoing volatility in the digital asset space.

The PENGU token, which launched on the Solana blockchain in December 2025, was primarily distributed through an airdrop to Pudgy Penguins NFT holders and select members of the Ethereum and Solana communities. This distribution strategy was designed to reward early supporters while expanding the token's reach across multiple blockchain ecosystems.

PENGU ETF Could Pioneer New Asset Category Beyond BTC and ETH

Currently, the US Securities and Exchange Commission (SEC) has only approved ETFs for Bitcoin and Ethereum, making them the only two digital assets accessible through this regulated investment vehicle structure. However, the landscape appears to be evolving rapidly, with numerous asset management firms recently filing ETF applications for other cryptocurrencies including Solana (SOL) and XRP, as reported by U.Today.

As part of its filing, Canary Capital has outlined plans to offer investors access to the portfolio's digital assets through traditional brokerage accounts, effectively removing many of the technical barriers and security risks associated with directly purchasing and storing cryptocurrencies and NFTs. This approach could significantly expand the potential investor base for these digital assets by making them accessible through conventional investment channels.

Beyond PENGU: The ETF's Comprehensive Digital Asset Strategy

The proposed ETF would not limit its holdings to just PENGU tokens and Pudgy Penguins NFTs. According to the filing, Canary Capital intends to include other related digital assets such as Ethereum (ETH) and Solana (SOL) that are directly or indirectly connected to either the PENGU token or the Pudgy Penguins NFT ecosystem. This comprehensive approach reflects the interconnected nature of the digital asset ecosystem and provides investors with broader exposure to the underlying technologies supporting these projects.

If approved, the PENGU ETF could transform the NFT market. Despite significant retail interest, the market has struggled to gain recognition as a legitimate asset class among institutional investors. Many NFT projects have faced challenges establishing long-term value propositions beyond initial collection hype, making regulated investment vehicles potentially crucial for broader market adoption.

The timing of this ETF application coincides with increasing regulatory clarity around digital assets in the United States, though significant hurdles remain before approval can be expected. The SEC has traditionally taken a cautious approach to cryptocurrency ETFs, with the first Bitcoin ETF approvals coming only after years of applications and regulatory deliberation.

Industry observers closely watch this development under the hashtag #Penguiana, recognizing that SEC approval of an NFT-holding ETF would set a precedent that could potentially open the floodgates for similar investment products focused on other prominent NFT collections and their associated tokens.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah