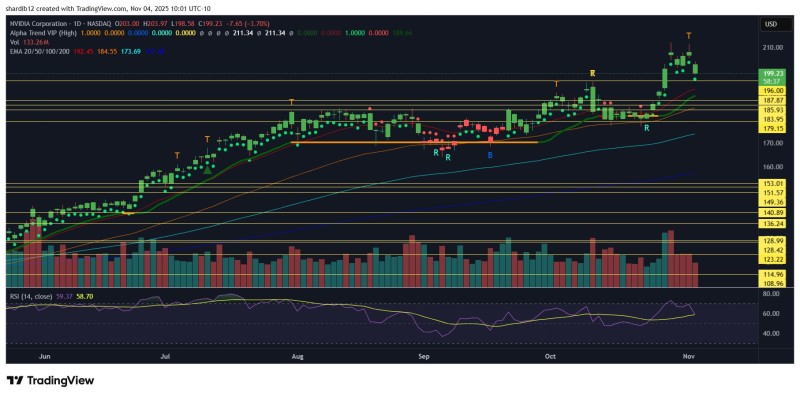

After a strong October rally, NVIDIA (NVDA) is taking a breather. The stock fell 3.7% to $199.23, confirming what technical traders call a “daily top” pattern — basically, a signal that the short-term rally might be losing steam. The timing isn’t ideal, with AMD’s earnings just around the corner; whatever AMD reports could shake up the entire chip sector.

What the Chart Is Saying

Market analyst Don't follow Shardi B If You Hate summed it up: “NVDA confirming TOP on daily — not great going into $AMD earnings, but we’ll see.”

NVIDIA's daily chart shows a clear rejection happening at the upper end of its trading range. Here's what's standing out:

- Resistance around $203–$211: NVIDIA tried multiple times to break through but kept getting pushed back down with consistent selling pressure

- Key support at $196: That's where the 20-day moving average sits—lose that, and the next stop is likely $187–$185

- Volume and momentum cooling: Trading volume spiked during the pullback, suggesting real distribution, not just light profit-taking. The RSI dropped to 59 from overbought levels above 70, signaling momentum fatigue

If NVIDIA holds above $196, this could just be healthy consolidation. But a close below $185 might trigger a deeper pullback.

Why the Weakness Now?

Timing matters. NVIDIA's pullback is happening right as AMD gears up to report earnings, and traders are nervous about what that might mean for AI chip competition and data center demand. Add in rising bond yields and some cooling enthusiasm for high-priced growth stocks, and you've got a sector on edge. NVIDIA rallied over 20% in October, so a breather makes sense—but it also shows how much these valuations depend on AI hype staying strong.

The big question is whether this is just a pause or the start of something bigger. If AMD delivers solid numbers, sentiment could flip fast and push NVIDIA back toward $203–$211. But if AMD disappoints, we could see a test of that $185 support level. For now, NVIDIA's long-term trend is still intact—it's holding above major moving averages—but the short-term setup is shaky. Traders are watching closely to see if this is a quick dip before the next leg up, or a deeper reset in the making.

Peter Smith

Peter Smith

Peter Smith

Peter Smith