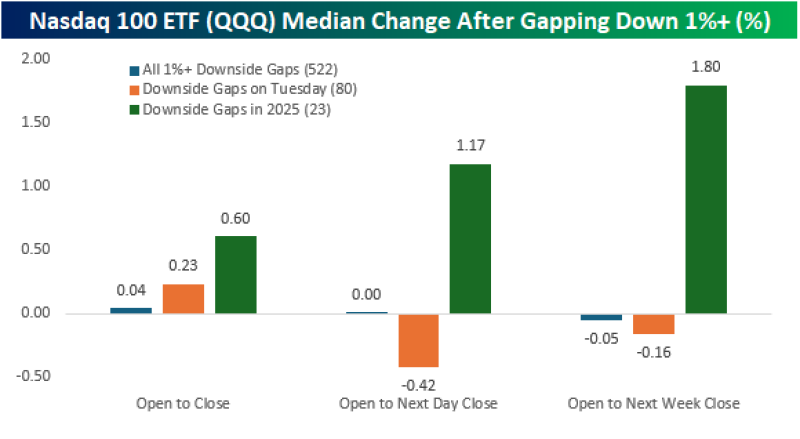

● The Nasdaq 100 ETF ($QQQ) has opened down more than 1% twenty-four times in 2025, and each time, traders have treated it as a buying opportunity. According to Bespoke, the median move from open to close on these gap-down days has been +0.6%, with gains extending to +1.17% by the next day's close.

● This "buy-the-dip" mentality has been remarkably consistent this year, especially in tech-heavy stocks. When $QQQ opens sharply lower, retail and algorithmic traders jump in quickly, often erasing most of the losses by the closing bell.

● But there's a catch. While these rebounds look impressive in the short term, they could be masking underlying fragility. If macro conditions worsen—rising yields, geopolitical tensions, or disappointing earnings—this reflexive buying might not hold up, potentially leading to deeper sell-offs in major growth sectors.

● Bespoke's data also shows that while intraday and next-day returns are strong, the effect tends to fade over a weekly timeframe. This suggests that while short-term traders are capitalizing on volatility, longer-term institutional investors remain cautious.

Peter Smith

Peter Smith

Peter Smith

Peter Smith