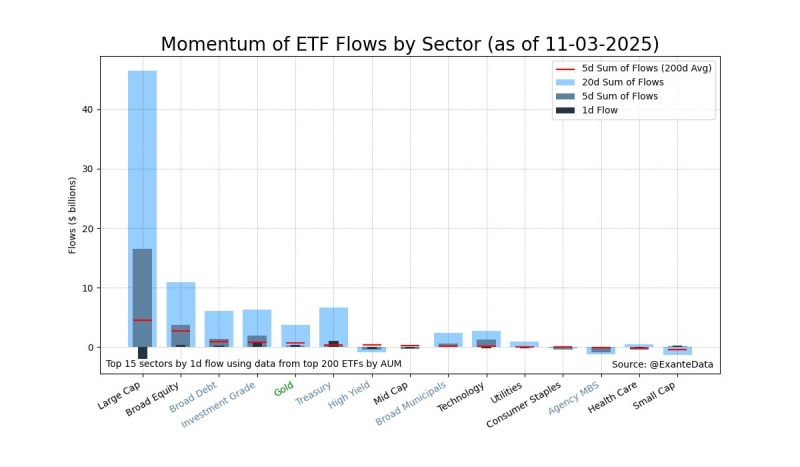

● Money is pouring into Large Cap and Technology ETFs while leaving sectors like mortgage-backed securities and consumer staples behind, according to fresh analysis from Exante Data. Their November 3, 2025 chart tracking ETF momentum shows investors doubling down on mega-cap growth stocks despite ongoing market choppiness.

● What's driving this shift? People want safety and steady earnings from big established companies. At the same time, they're backing away from defensive plays and rate-sensitive investments like Agency MBS and Consumer Staples. The downside? If markets turn south, these concentrated bets could get hit harder than a more balanced portfolio.

● The flow patterns tell us a lot about where investors think interest rates and monetary policy are headed. Large Cap ETFs have been pulling in cash well above their 200-day average for weeks now, as money rotates out of bonds and smaller stocks. Exante Data's numbers show more than $40 billion net flowing into Large Cap and Tech, while MBS and Consumer Staples bleed capital. Investors are clearly favoring liquid, scalable assets they see as safer long-term holds when policy feels uncertain.

● These kinds of concentrated flows often signal what's coming next in sector performance. When this much money moves this fast, it can amplify swings and create valuation gaps across different industries—affecting everything from major indexes to derivatives. The pullback from Agency MBS also suggests ongoing worry about credit spreads and real estate exposure.

Sectors experiencing the largest inflows compared to their averages include Large Cap and Technology, while outflows are being seen in Agency MBS and Consumer Staples. As Exante Data put it

● The takeaway is clear—capital is chasing U.S. growth leaders, even as everyone braces for earnings to potentially normalize next year.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi