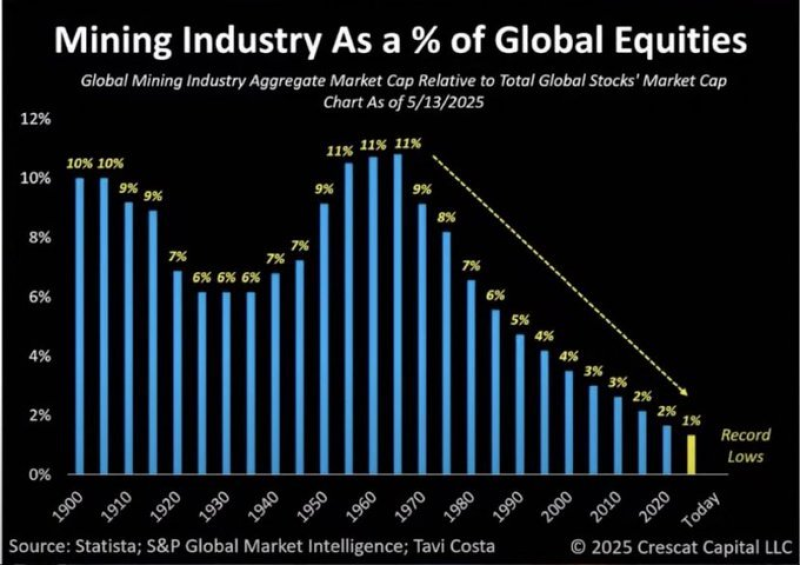

The mining industry has quietly shrunk to its smallest footprint in modern financial history. A new chart tracking long-term trends shows the sector commanding roughly 1% of global equities as of mid-May 2025, down from double-digit percentages in previous decades. This collapse comes at an unusual moment: while mining equities hold only slim portions of the market, the race to control physical resources has intensified dramatically.

From 10% to 1%: A Decades-Long Decline

Mining represented between 10% and 11% of global equities during several historical peaks, then steadily contracted through the late 20th century and 2000s. The decline reflects a broader economic shift toward globalization, where offshoring, lean inventories, and just-in-time logistics dominated corporate strategy. Cheap energy and abundant materials allowed companies to operate asset-light models with minimal concern for supply disruptions.

That era is ending. The global economy is pivoting toward a bifurcated system where "supply security is increasingly prioritized over efficiency." Strategic stockpiles are expanding, export controls are multiplying, and access to raw materials now carries national-security implications.

Tech Giants Lock Down Copper at the Source

Large technology firms are bypassing traditional commodity markets entirely. They're signing long-term offtake agreements directly with mines, building or controlling their own power generation, and pursuing end-to-end supply chains. Copper price holds near $5.97 as U.S. COMEX stockpiles hit 30-year high, yet companies are locking in supply years in advance—a sign that availability matters more than spot pricing.

This assumption is breaking down as strategic stockpiles expand and export controls rise, highlighting how governments and corporations are competing for finite ore bodies rather than relying on open markets.

Governments Step In: Mining Becomes Strategic Priority

The U.S. government's recent involvement underscores this shift. Trilogy Metals stock surges after U.S. government stake, marking a rare direct investment in domestic mining capacity. Such moves signal that metals tied to electrification, defense, and infrastructure are no longer purely commercial concerns—they're matters of state planning.

With mining at a historically small slice of global equities, a gap has opened between the sector's market representation and its strategic importance. As one observer put it, mining has moved "from a neglected sector into a national-security-linked priority where access can matter more than price."

What's Next for Mining Equities?

If supply security continues to outweigh cost optimization, the 1% figure may represent a structural mismatch. Investors tracking resource availability and industrial capacity will likely watch how policy, corporate offtake agreements, and geopolitical tensions reshape mining's role in portfolios—especially for metals critical to energy transition and infrastructure buildouts.

Peter Smith

Peter Smith

Peter Smith

Peter Smith