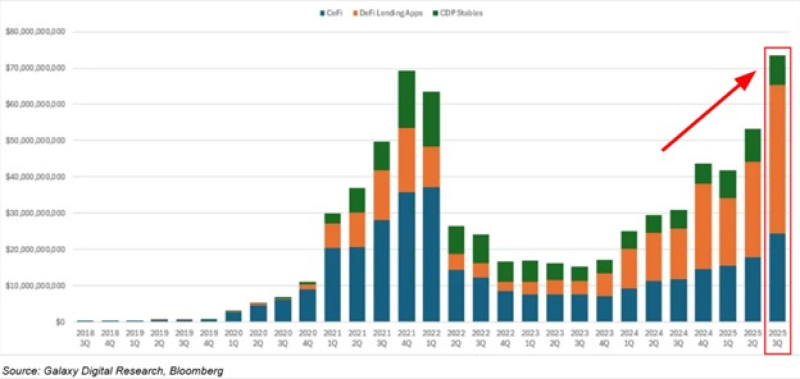

⬤ Crypto markets are entering a fresh wave of aggressive borrowing, with total crypto loans jumping 35% in Q3 2025 to reach a record $73.6 billion—surpassing even the previous high of $69.4 billion from late 2021. The data shows that lending across centralized finance platforms, DeFi protocols, and collateralized debt position stablecoins has collectively hit its peak. This uptick follows the sector's strong comeback that started in early 2024, when institutional money flooded back in after US regulators approved spot Bitcoin ETFs, triggering rapid growth in crypto lending.

⬤ With leverage ramping up, more analysts and policymakers are pushing for tighter oversight of crypto borrowing to avoid systemic problems down the line. Without better safeguards in place, the industry risks facing a domino effect of liquidations, platform collapses, and potentially losing top talent who don't want to work in unstable markets. The Kobeissi Letter noted that "total crypto loans jumped +35% in Q3 2025," pointing out that this spike is already creating serious market stress. The key issue here is that leverage itself is amplifying volatility at a time when crypto's market infrastructure is still shakier than traditional finance.

⬤ The dangers go way beyond just short-term price drops. Heavy leverage raises the odds of sudden crashes, speeds up forced selling, and increases the chance that both borrowers and platforms could face liquidity problems.

We are seeing violent downswings across the board in crypto as liquidations accelerate, adding that leverage is proliferating volatility. The Q3 2025 figure shown at the far right of the chart makes this trend crystal clear: the market is now carrying more borrowed money than ever before. The Kobeissi Letter warned that

⬤ As leverage-driven turbulence increasingly shapes this crypto market news cycle, the industry is reaching a critical moment. Record borrowing levels might look like a sign of renewed confidence, but they're also exposing serious structural weaknesses. With volatility climbing and liquidations picking up speed, exchanges, lenders, and regulators are facing mounting pressure to roll out reforms before the next downturn turns market instability into a full-blown systemic crisis.

Peter Smith

Peter Smith

Peter Smith

Peter Smith