Over the past few weeks, FXRP's expansion on Flare Networks has sparked a noticeable uptick in on-chain activity. Whenever the FXRP market cap climbs, DeFi participation follows suit.

What the Numbers Show

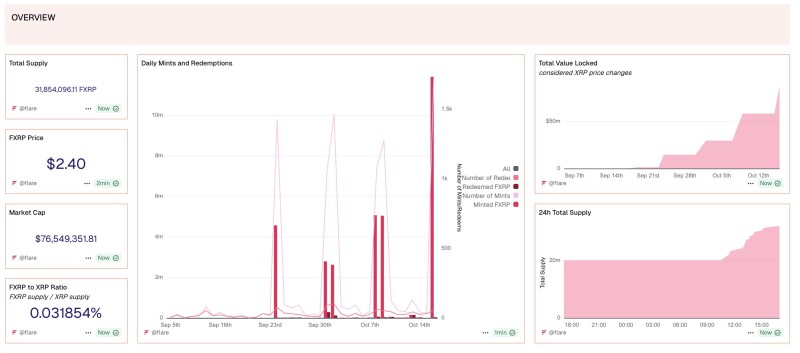

According to Flare, this pattern shows that FXRP is quickly becoming one of the most effective tools for building decentralized finance around XRP. The dashboard paints a clear picture of FXRP's momentum: over 31.85 million FXRP has been minted, with the price holding steady at $2.40—tracking closely with XRP's overall market performance. The market cap has pushed past $76.5 million, reflecting rapid growth. Daily minting and redemption activity shows sharp spikes, pointing to genuine demand and active user engagement. Total Value Locked has climbed significantly, approaching $50 million by mid-October, while the FXRP to XRP ratio sits at 0.0318%, indicating steady tokenization of XRP on Flare's EVM-compatible chain.

Why It Matters

This isn't just a technical achievement. The rising FXRP metrics signal that XRP is embedding itself deeper into EVM-based DeFi protocols. XRP holders now have more liquidity options, and the asset is finding utility beyond its traditional role in payments and remittances. Flare is also strengthening its position as a cross-chain interoperability hub. The surges in minting and redemption aren't just speculative noise—they suggest that FXRP is being used as collateral, liquidity, and a foundational element in decentralized applications.

If this expansion keeps up, Flare could emerge as the primary driver of XRP adoption within the EVM ecosystem. For investors and developers, this represents a shift in XRP's identity—it's no longer just a payments asset. It's becoming a core piece of DeFi infrastructure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah