The currency markets are painting a fascinating picture right now, with the US Dollar Index hitting a wall just as the euro shows signs of life. While most retail traders are still chasing yesterday's dollar strength, institutional money seems to be positioning for a different story entirely.

DXY Hits a Brick Wall at 98.20 – Is This the Top?

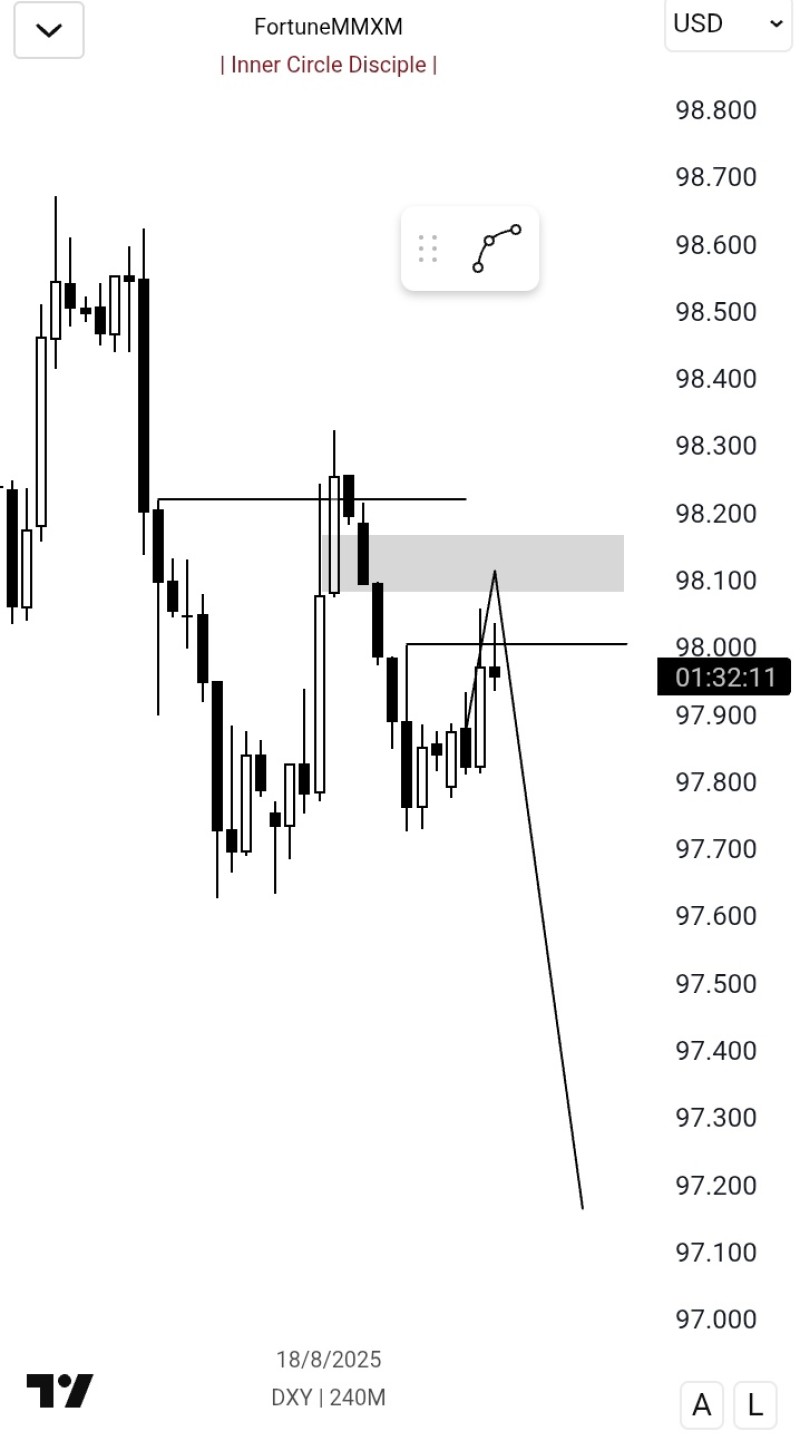

The US Dollar Index is telling us a story that many aren't listening to yet. After that bounce from 97.80 looked promising, reality hit hard at 98.20 – and the rejection was swift and decisive.

Here's what's actually happening: sellers aren't just present, they're aggressive. Every time DXY tries to push through that 98.20 ceiling, it gets smacked down harder than before. This isn't just technical noise – it's institutional money saying "not so fast."

The writing's on the wall for a potential drop back to 97.20, maybe even 97.00 if this weakness persists. What looked like dollar strength just weeks ago is starting to feel more like a dead cat bounce. The momentum beneath 98.00 is cracking, and smart money knows it.

EUR/USD Ready to Make Its Move – Finally

While the dollar stumbles, EUR/USD is quietly setting up what could be the trade of the month. After weeks of grinding sideways near 1.1680, the pair is eyeing that critical 1.1740 level like a predator watching its prey.

The technical setup here is textbook bullish. We're not talking about hopium or wishful thinking – the price action is screaming "breakout incoming." If EUR/USD can muscle its way above 1.1720-1.1740, we're likely looking at a fast move toward 1.1780.

This isn't just about technicals either. The fundamental backdrop is shifting, and European assets are starting to look attractive again. Smart money is positioning for this move, and retail is still catching up.

Usman Salis

Usman Salis

Usman Salis

Usman Salis