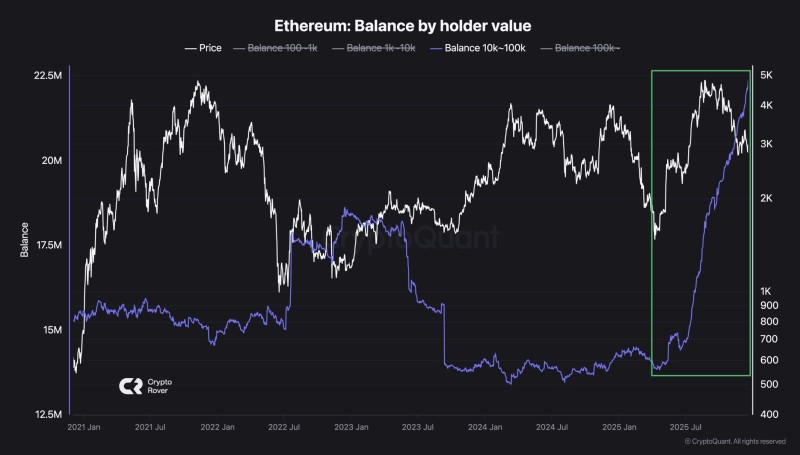

⬤ Ethereum's getting attention again as on-chain data reveals large holders are seriously stacking up ETH. The latest numbers show wallets holding between 10,000 and 100,000 ETH have ramped up their balances while the price stays elevated. What's interesting here is that these whales are buying during consolidation, not selling into strength like you'd typically see at cycle tops. This kind of behavior suggests they're positioning for something bigger down the road.

⬤ The accumulation kicked into high gear in early 2025 after months of whale balances staying relatively flat or even dropping. Meanwhile, ETH price has been trading sideways in a broad range without any major breakout. This tells us that big players are using this consolidation phase to load up rather than cash out—a pattern that looks different from previous market peaks where whales often distributed their holdings as prices climbed.

⬤ Looking at historical patterns, earlier whale accumulation phases happened more gradually. But this recent surge in the 10,000 to 100,000 ETH category is noticeably steeper and more concentrated. The pace of accumulation is much faster than what we've seen in prior months, pointing to a real change in strategy among these major holders rather than just business as usual.

⬤ Why does this matter? When whales increase their holdings, it can tighten supply on the open market and make price more sensitive to demand shifts. Fewer coins circulating means any uptick in buying pressure could have a bigger impact. Plus, seeing this level of accumulation at relatively high prices shows these major players have confidence in ETH's outlook. As Ethereum continues trading in its current range, watching how price action and whale positioning interact will be crucial for understanding where the market heads next.

Peter Smith

Peter Smith

Peter Smith

Peter Smith