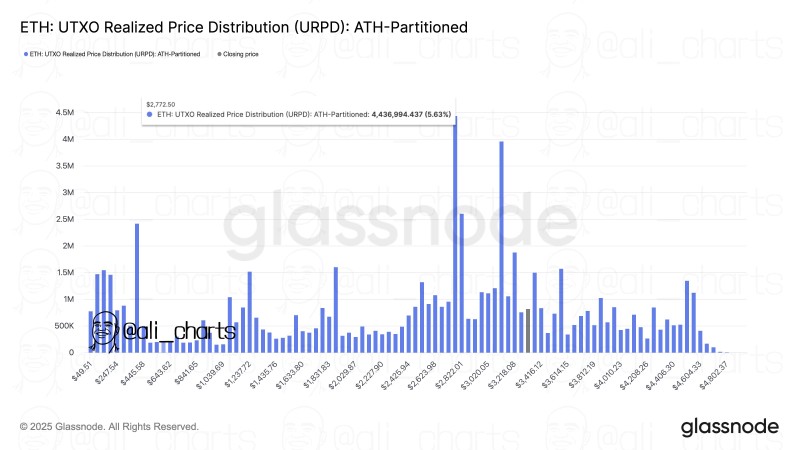

⬤ Ethereum now hovers above a single on chain price level that will decide its next step. Analysis shows that $2,770 is the key support line - below it, long term holders paid for large tranches of coins. Glassnode's latest URPD release lists every price at which meaningful ETH amounts last moved and the list points to one crowded zone.

⬤ The heaviest cluster sits at $2,772.50. About 4.44 million ETH, 5.63 % of the tracked supply, last changed hands there. Because serious buyers paid that price, they tend to defend it. One observer summed it up: “The $2,770 region is Ethereum's main floor under the current structure.”

⬤ Other traded price blocks appear near $3,000, $3,214 and the mid-$3,800 area - yet none hold as many coins as the $2,770 band. ETH now trades between those lighter overhead blocks plus the thick floor beneath, a setup that looks steady but cracks under pressure.

⬤ The level matters because past trade price bands serve as cushions in pull backs. If the market stays above $2,770, holders signal trust and deeper drops stay unlikely. A daily close beneath that price would push ETH into the thinly traded part of the profile and could flip the short term trend. As volatility rises, this record of paid prices offers the clearest map of where Ethereum is apt to bounce or break.

Peter Smith

Peter Smith

Peter Smith

Peter Smith