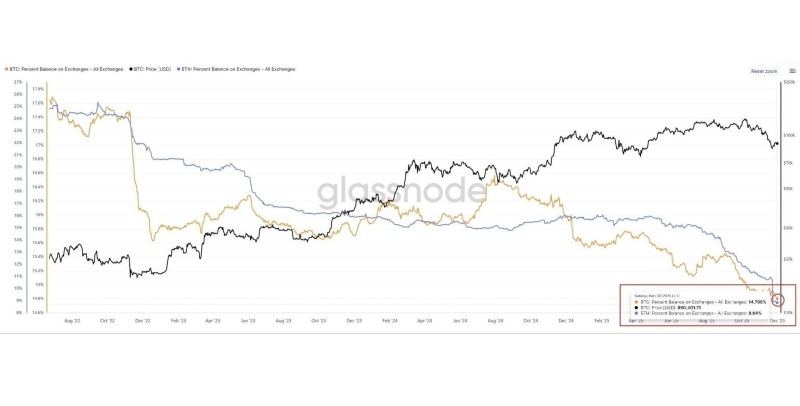

⬤ Ethereum is seeing a major pullback in available supply as the amount of ETH sitting on exchanges hits levels not seen in nearly a decade. Recent data shows exchange balances have dropped to around 8.84% by late November, marking a dramatic change in how people are holding and using their ETH.

⬤ The numbers tell a striking story: exchange balances have fallen 43% since July alone. More and more ETH is being moved into staking contracts, layer-2 solutions, DeFi platforms, and cold storage. The trend has been consistent throughout the year, showing that traders are pulling their holdings off exchanges regardless of price swings. This steady outflow points to fundamental shifts in how Ethereum's liquidity works.

⬤ With less than 9% of total ETH now available on exchanges, selling pressure has naturally decreased. Most of the supply is being locked up through staking or put to work across the network. While Bitcoin balances show some decline too, Ethereum's drop stands out for how sharp and persistent it's been.

⬤ Why does this matter? When exchange supply shrinks this much, it can create interesting market conditions. If demand picks up, there's simply less ETH available to meet it, which could lead to bigger price moves than usual. As more coins get staked or moved into cold wallets, the whole liquidity picture changes—potentially setting the stage for increased volatility or even a supply-driven rally down the road.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets