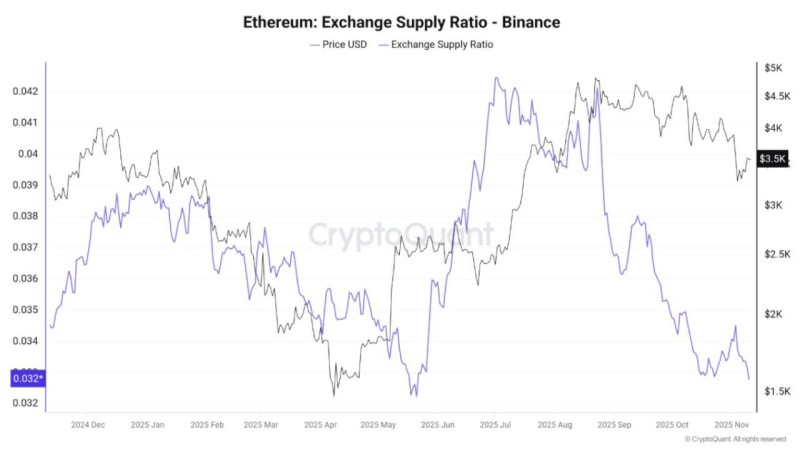

⬤ New on-chain data shows that Ethereum's supply on Binance has hit its lowest level since last May. This drop in available ETH is generally seen as a positive sign—when fewer coins sit on exchanges, there's less immediate selling pressure. The chart tracking Binance's exchange supply ratio shows a steady decline even as Ethereum trades around $3,500.

⬤ This trend comes at an interesting time. Policymakers are still debating tax proposals and tighter reporting rules that could shake up the crypto industry, potentially forcing smaller firms to struggle or even pushing talent overseas to friendlier jurisdictions. But the shrinking exchange supply acts as a stabilizing force, helping cushion Ethereum against sudden liquidity-driven selloffs during this uncertain regulatory period.

⬤ The data matters because coins on exchanges typically represent assets ready to be sold at any moment. When that supply keeps dropping, it suggests more holders are moving their ETH into long-term storage, staking, or cold wallets—not preparing to dump it. The chart makes this shift crystal clear, showing a sharp divergence between Ethereum's price action and the falling exchange supply ratio over recent months.

⬤ For investors, this is worth paying attention to. Lower exchange supply can mean less volatility and better conditions for accumulation, especially when regulatory clouds are hanging overhead. With sell-side liquidity drying up on one of the world's biggest exchanges, Ethereum looks better positioned for medium-term strength—backing up the bullish read on the latest CryptoQuant numbers.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets