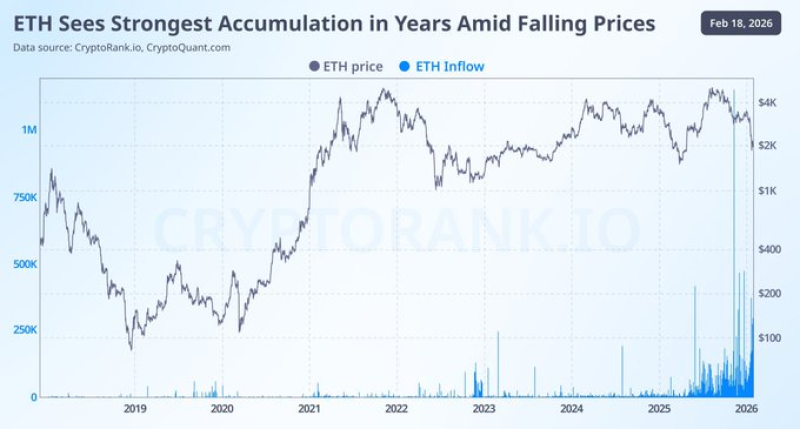

⬤ Ethereum's price might be struggling, but something interesting is happening behind the scenes. While ETH has been trending lower, long-term holders are actually buying more, not less. According to data from CryptoRank, accumulation activity has hit levels we haven't seen in years. The chart tracking ETH price alongside inflow data shows a clear pattern - even as prices dropped through late 2025 and into early 2026, those inflow spikes kept getting bigger.

⬤ What makes this particularly noteworthy is the timing. Looking at the 2018-2026 period, the recent surge in accumulation is happening during a pullback, which typically signals strong conviction from holders who are willing to add to positions when prices are weak. At the same time, there's another milestone worth noting: more than 50% of all ETH is now staked. That's a first for Ethereum, and it means a substantial chunk of supply is locked up and earning rewards rather than sitting on exchanges ready to sell. For more context on this trend, check out ETH accumulation hits multi-year high as Ethereum staking surpasses 50% of total supply.

⬤ The combination of heavy buying and increased staking isn't happening in isolation. There's continued progress in technical development, steady growth across DeFi platforms, and more institutional players getting involved with Ethereum infrastructure. The chart doesn't give us a specific price prediction, but it does show that structural participation is holding strong even when sentiment feels shaky. Similar patterns have been covered before, including when ETH drops below $2,940 whale cost basis as accumulation inflows spike and Ethereum news: whales drain exchanges as supply hits record low.

⬤ Why does this matter? When accumulation peaks during price weakness and supply gets locked in staking, it changes the equation. If market conditions turn around, these supply dynamics could provide meaningful support for Ethereum's recovery.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi