Something interesting is happening beneath Ethereum's price decline. While the market has been trending lower, on-chain data tells a different story: long-term holders are accumulating more aggressively than they have in years, and staking participation just crossed a major milestone.

ETH Accumulation Reaches Multi-Year Peak Amid Price Weakness

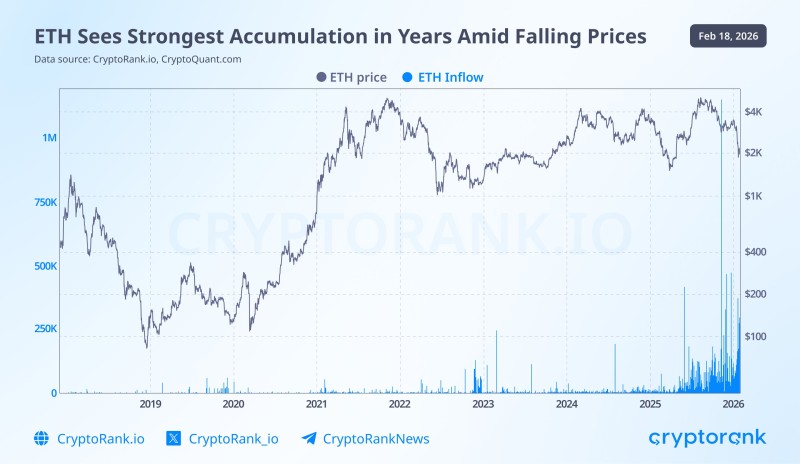

According to CryptoRank.io, long-term ETH holders have been steadily building their positions throughout the current downturn. A February 18, 2026 chart shows ETH inflow spikes expanding even as the price moves lower, which is exactly the kind of divergence that signals deliberate Ethereum accumulation trends rather than panic selling.

CryptoRank describes this as the strongest accumulation seen in years, with inflows picking up sharply into 2025 and continuing through early 2026.

The strongest accumulation in years, with inflows rising sharply into 2025 and early 2026.

At the same time, staking levels have crossed 50% of total ETH supply for the first time, meaning a significant chunk of ETH is locked rather than actively circulating. That kind of supply tightening during a downturn tends to matter once sentiment turns around.

Institutional Adoption and DeFi Growth Support ETH Market Outlook

CryptoRank also highlights several structural tailwinds running alongside the accumulation activity: continued technical development on the Ethereum network, expansion of the decentralized finance sector, and growing institutional adoption. These aren't short-term catalysts but longer-term signals of sustained Ethereum adoption growth that tend to underpin demand regardless of where spot prices sit on any given week.

Taken together, rising accumulation, record staking participation, and ongoing ecosystem development paint a picture of a network that people are committed to even when price action is uninspiring. How quickly that commitment translates into upward movement depends on the broader ETH market outlook and when wider market sentiment decides to catch up.

Peter Smith

Peter Smith

Peter Smith

Peter Smith