Ethereum (ETH) has been stuck in neutral lately, hanging around $3,875 after dropping 3.7% this week. On the surface, things look quiet — maybe too quiet. Because while most traders aren't paying attention, some of the biggest wallets in crypto have been making serious moves. Over just two days, whales accumulated roughly $660 million worth of ETH, reigniting hopes that a rebound might be brewing. But there's a catch. Short-term holders are dumping into every bounce, creating a stubborn wall of selling pressure that's keeping any rally attempts dead in their tracks.

Ethereum (ETH) Whales Buy Big While Quick Traders Run for the Exit

On-chain data tells the real story. Between October 21 and October 23, Ethereum whales added about 170,000 ETH to their stacks, pushing their total holdings from 100.30 million to 100.47 million ETH. At current prices, that's around $660 million in fresh buying — one of the biggest whale accumulation sprees we've seen all month. These deep-pocketed players clearly think ETH is cheap here.

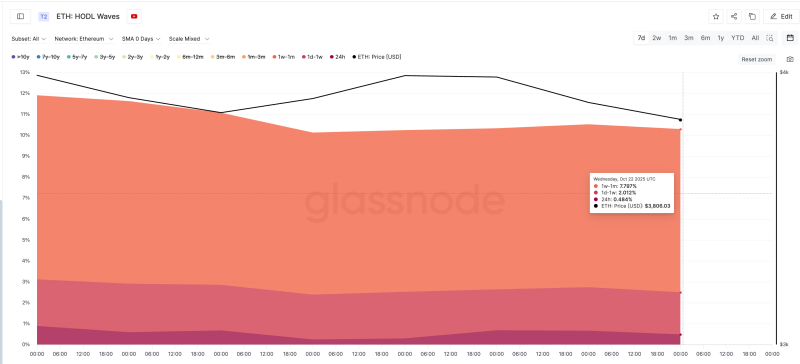

But while the smart money loads up, short-term holders are heading straight for the exits. HODL Waves data shows three groups of quick-flip traders have all reduced their positions since mid-October. The 24-hour holder group dropped from 0.887% to 0.48% of supply. The 1-day to 1-week crew fell from 2.22% to 2.01%. And the 1-week to 1-month holders declined from 8.79% to 7.79%.

The message is clear: whales are betting on ETH's future, but short-term traders aren't buying it — literally. This tug-of-war is exactly why Ethereum can't seem to break out of its current range. Until these nervous sellers regain confidence or simply run out of coins to dump, whale buying alone might not be enough to spark a real rally.

ETH Price Prediction: Bulls Eye $4,950 Target, But $3,800 Support Must Hold

Despite the selling pressure, Ethereum's chart actually looks pretty solid. The daily timeframe shows ETH making lower lows from September 25 through October 22, but here's the interesting part — the RSI has been making higher lows during the same period. This bullish divergence often shows up right before momentum shifts, even when price action still looks weak.

ETH is also trading inside an ascending triangle, a pattern that usually breaks upward once resistance gets cleared. The key levels to watch are $3,989 and $4,137, both lining up with major Fibonacci retracement zones. Breaking above these would confirm the triangle breakout and potentially kick off the next leg higher.

For the bulls to really take control, ETH needs a daily close above $4,137 — that's about 7% from here. If that happens, the path opens up to $4,495, with $4,950 in play over the following weeks. But if ETH loses the $3,806 support, things could get ugly fast. A breakdown would likely send price down to $3,511 or even $3,355, completely killing the bullish setup and bringing the bears back in force.

The next few days will tell us which way this goes.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi