The largest Ethereum memecoin, $PEPE, sees a 7% drop as significant whale activity impacts market sentiment and highlights trading risks.

$PEPE Experiences Continued Decline Amid Whale Movements

The largest Ethereum memecoin, $PEPE, has faced a notable decline of up to 7% today, with significant activity from a major address adding to market volatility. The address, 0xf22…a685c, has been actively trading large volumes of $PEPE, impacting its price and investor sentiment.

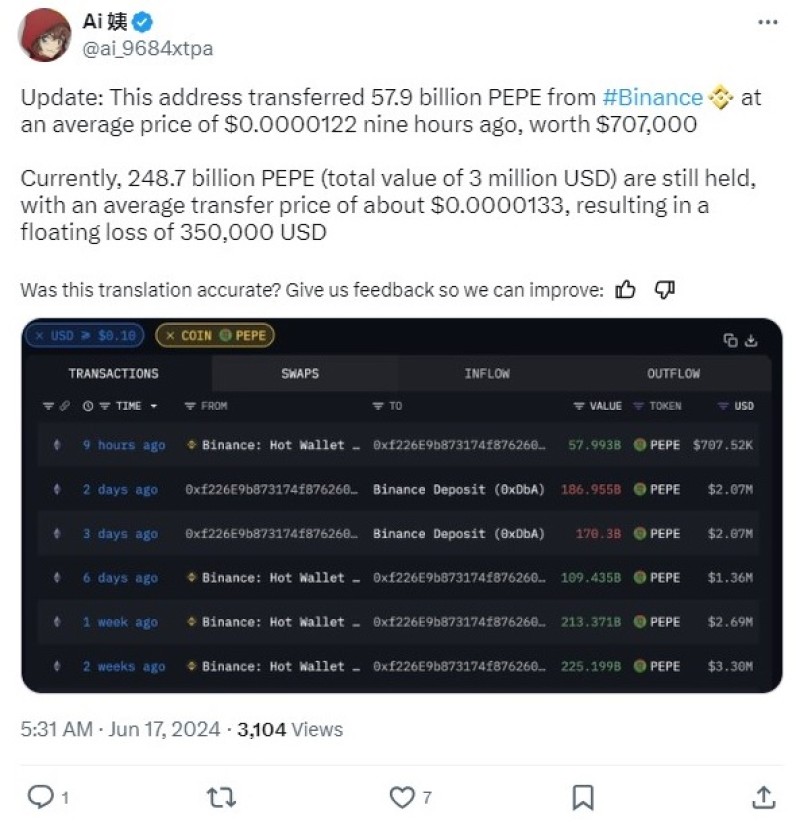

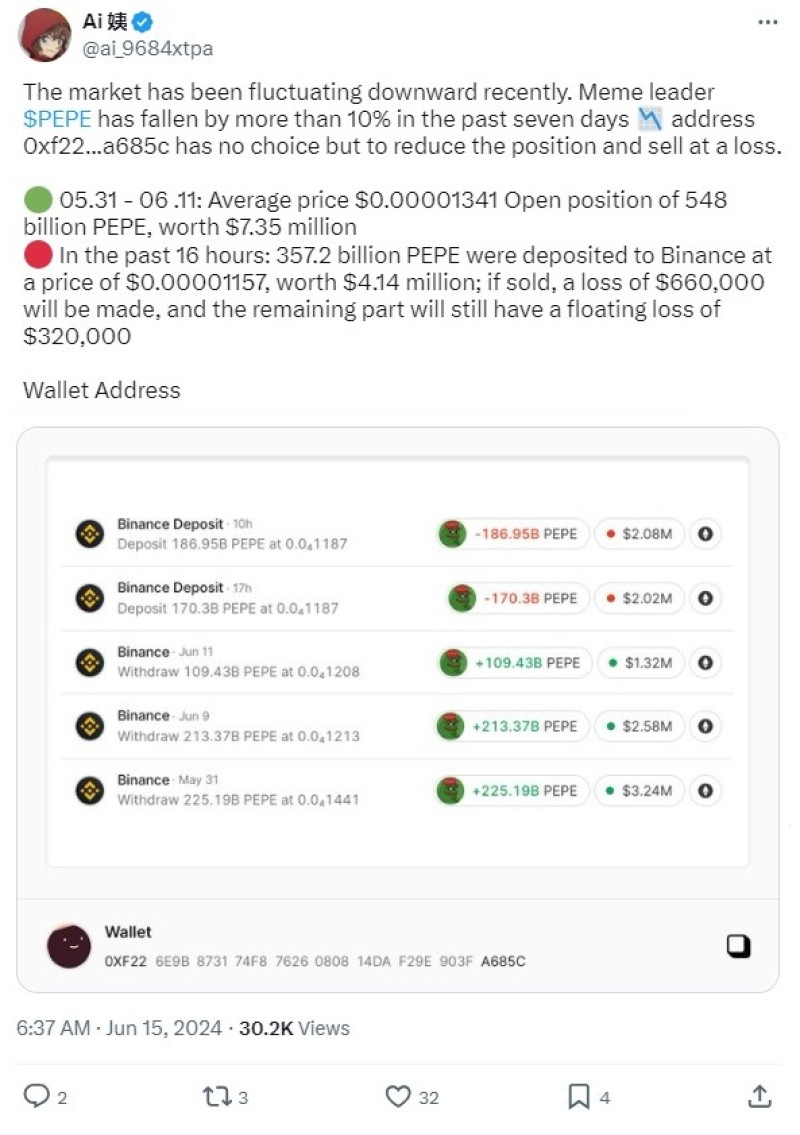

In the past two days, the address in question deposited 357.2 billion $PEPE to Binance, realizing a loss. Today, the same address transferred 57.9 billion $PEPE from Binance at an average price of $0.0000122, totaling $707,000. Despite these trades, the address still holds 248.7 billion $PEPE, valued at $3 million, with an average transfer price of $0.0000133, resulting in a floating loss of approximately $350,000.

Strategic Moves to Mitigate Losses

In an attempt to lower the average cost and potentially recover from losses, the address added another 104.6 billion $PEPE, worth $1.25 million. This increased the holdings to 353.4 billion $PEPE, valued at $4.23 million, and lowered the average cost to $0.0000131. However, the position still represents a floating loss. Shortly after this transaction, the address further increased its holdings by adding $500,000 worth of $PEPE. Currently, the latest holdings stand at 394.8 billion $PEPE, valued at $4.74 million, with an average cost of about $0.00001304.

The recent actions of this whale have significantly influenced market sentiment around $PEPE. The continuous acquisition of $PEPE holdings to lower the average cost reflects a strategic effort to mitigate losses but also underscores the inherent volatility and risk involved in trading memecoins. Investors are closely monitoring these movements, as the address’s actions could further impact $PEPE’s price and overall market dynamics.

Challenges and Unpredictability in the Memecoin Market

The persistent decline in $PEPE’s value, coupled with large-scale trading activities by whales, highlights the challenges and unpredictability within the memecoin market. The ongoing developments indicate the high-risk nature of trading such assets, where significant market movements by individual addresses can drastically alter price trends and investor sentiment.

In conclusion, as $PEPE continues to navigate through turbulent market conditions, the impact of whale activities remains a critical factor in its price trajectory. Investors remain cautious, aware of the potential for further volatility and the strategic moves made by significant players in the market. The future of $PEPE will likely be shaped by these ongoing dynamics and the broader sentiment within the cryptocurrency community.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah