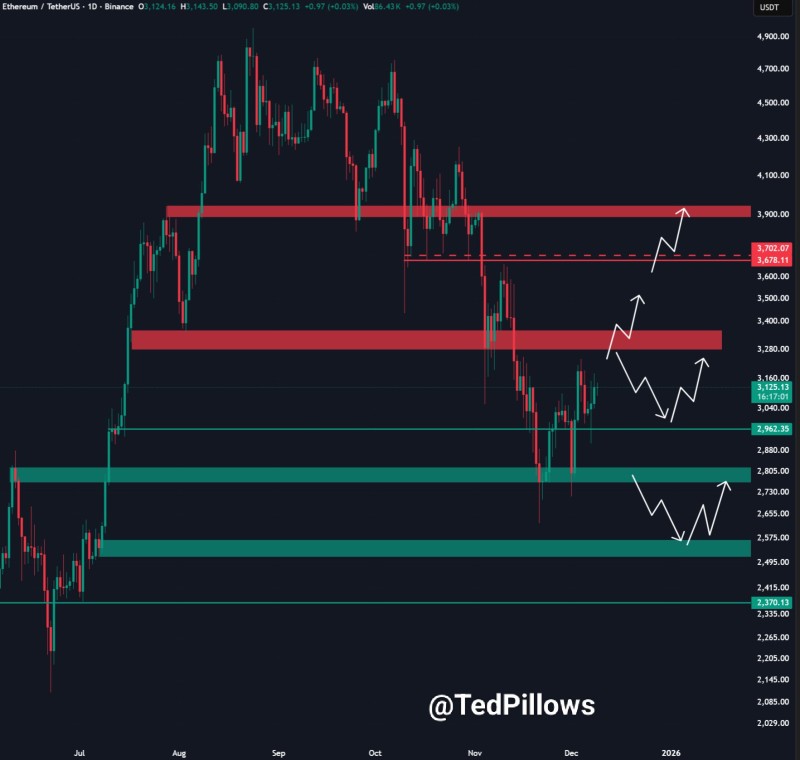

⬤ Ethereum has been holding steady above $3,100, with buyers actively protecting the broader $3,000-$3,100 support zone. This demand area has consistently absorbed selling pressure in recent sessions, preventing any significant drops. The chart shows multiple bounces from this level, establishing it as a critical short-term foundation for price action.

⬤ The next key resistance zone sits between $3,300 and $3,400—an area where ETH has stalled or reversed several times before. This range has acted as a ceiling for upward movement, repeatedly capping rallies. If Ethereum pushes through this resistance with strong volume, the path could open toward $3,700-$3,800, which aligns with previous consolidation areas.

⬤ The chart reveals multiple scenarios ahead. Holding above $3,100 keeps the momentum positive in the near term, but slipping below could send ETH down to support around $2,960 or lower liquidity zones. While buyers have shown up during pullbacks, selling pressure at higher levels continues to slow any sharp upward moves.

⬤ This price structure matters because Ethereum is sitting at levels that could shape broader market sentiment. A clean break above resistance might spark renewed energy across crypto markets, while rejection could extend the current consolidation phase and cool enthusiasm. With ETH at this pivotal point, the next few sessions will likely reveal whether a recovery is forming or if the range-bound trading continues.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov