After weeks of grinding lower, Ethereum might finally be catching a break. It's the first positive signal in months, and if history is any guide, it could be the early whisper of a turnaround.

What the Chart Is Saying

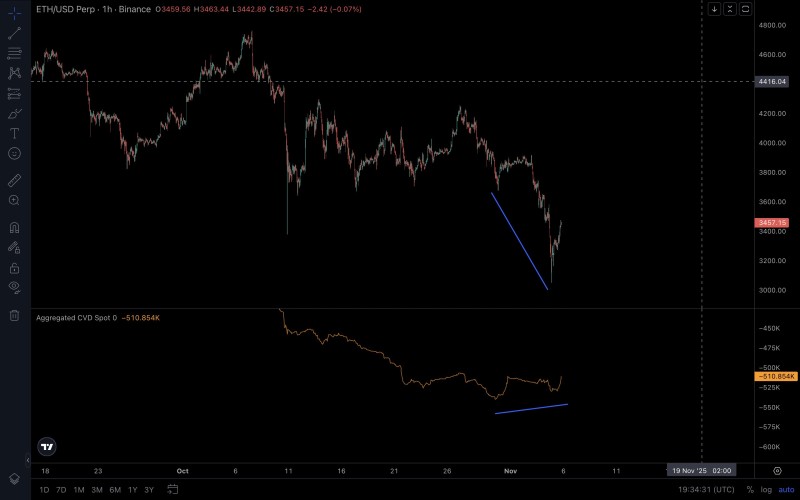

Analyst Hamza aka dr terk has spotted something encouraging: a bullish divergence between ETH's falling price and rising buying pressure on Coinbase.

The setup is textbook bullish divergence:

- ETH's price dropped from around $3,800 to $3,000—making a lower low

- CVD (Cumulative Volume Delta) on Coinbase made a higher low—showing buyers absorbing the dip

- The bounce has already started, with ETH reclaiming the $3,450–$3,500 zone

This kind of divergence typically means the selling is exhausting and accumulation is quietly beginning. It's the same pattern that played out when Coinbase buyers were scooping up ETH between $1,500 and $2,000—right before the rally toward $5,000. Now, after retracing most of that move, fresh buying is showing up again at similar accumulation levels.

What's Next?

ETH faces resistance around $3,600, with stronger supply near $3,800–$4,000. If it breaks through, a retest of $4,100–$4,200 could be on the table. Support is holding firm between $3,000 and $3,100—the zone where the divergence appeared. As long as ETH stays above that, buyers seem to be regaining control.

For now, the chart suggests Ethereum may be building a base rather than breaking down. If Coinbase's accumulation continues, this could be the start of a gradual climb back up—beginning right where the selling pressure started to fade.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah