Ethereum (ETH) recent price consolidation might be laying the groundwork for its next significant move. Data shows massive accumulation at a key price level, with long-term holders establishing what could become a crucial defense line.

Ethereum Builds Strong Foundation at $3,150

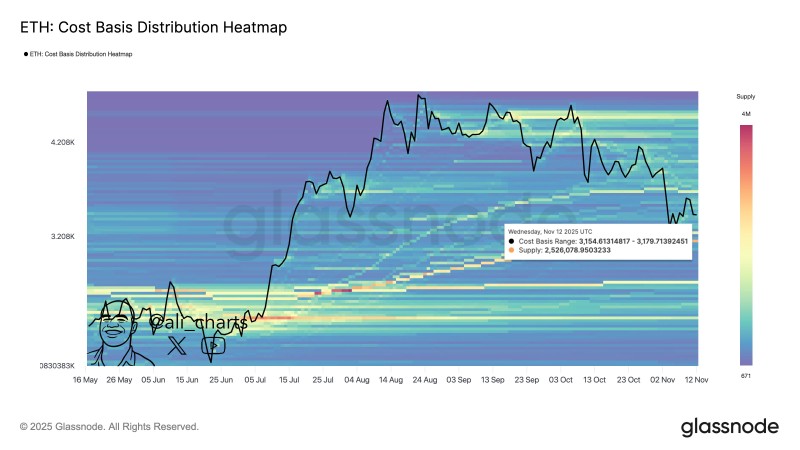

More than 2.53 million ETH changed hands around $3,150, and the Glassnode Cost Basis Distribution Heatmap confirms this as one of the most significant support areas in the current price structure.

The data shows a dense concentration of long-term holders positioned in the $3,150–$3,180 range, marking a zone where buyers have consistently stepped in.

What the Data Shows

The cost-basis distribution chart reveals that between $3,154.61 and $3,179.71, roughly 2.53 million ETH was accumulated. This represents one of the largest accumulation zones on the chart, and when millions of coins get purchased in a tight range, it usually creates a solid support floor since holders naturally defend their entry points.

ETH traded sideways from mid-May through mid-June, shot up in July, climbed past $4,000 by September, then pulled back in October and early November. Every significant dip since August has tested this cluster but hasn't broken through cleanly, suggesting the market recognizes $3,150 as a structural level worth defending.

The area above $4,200 shows much thinner distribution, meaning fewer buyers entered at those elevated prices. This explains the weak resistance at the highs and why the rally lacked deep support. Between July and September, the heatmap shows new batches of ETH gradually lifting their cost basis as price trended higher, reflecting sustained accumulation and steady demand.

Why Investors Are Buying Here

Upcoming Ethereum upgrades focused on scalability and Layer 2 expansion continue attracting long-term investors. The growing amount of ETH locked in staking contracts reduces circulating supply, making the market more sensitive to supply-demand imbalances. Institutional adoption keeps expanding, with ETH becoming a core holding in crypto portfolios. Historically, Ethereum accumulation increases during mid-cycle consolidation phases, and the current period fits that pattern.

Critical Levels to Monitor

The $3,150 level serves as major on-chain support with $3,000 providing backup. On the upside, $3,450 represents local resistance, while $3,800–$4,000 marks the upper supply zone. A decisive breakout above $3,450 would signal returning bullish momentum.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi