Ethereum (ETH) is trading above $3,500 again after bouncing from recent lows. This puts ETH right in the middle of a price zone that's been acting as both support and resistance for weeks. The asset is now retesting a supply region that previously triggered several sharp drops, making this a high-risk, high-reward moment.

While the recovery signals renewed buying interest, the structure remains fragile. The next daily close could set the tone for Ethereum's short-term direction. With liquidity tightening and volatility picking up, traders are watching this level closely.

Chart Analysis: The Battle at Resistance

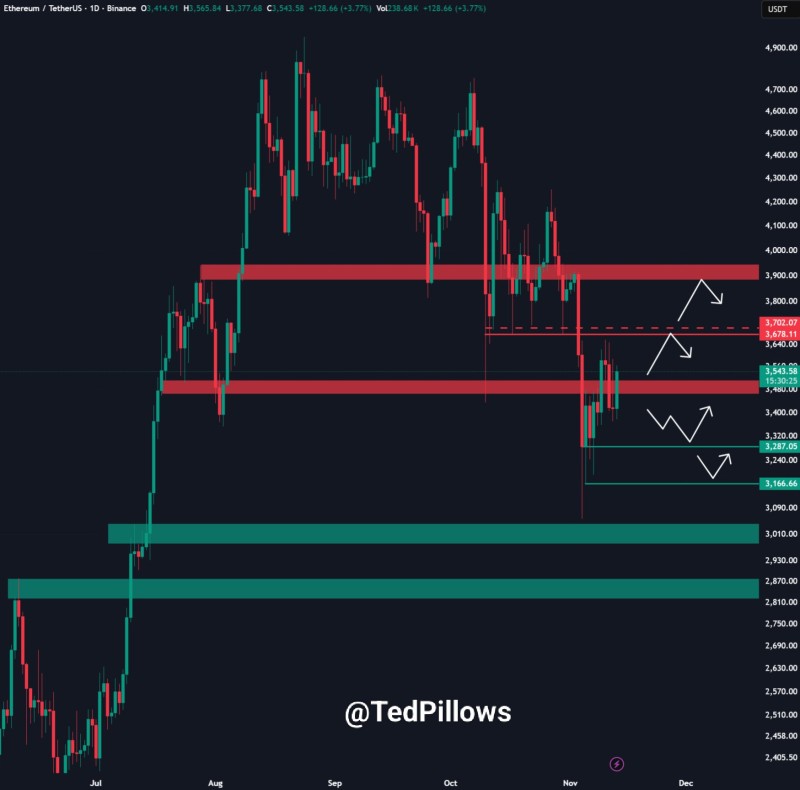

The chart shows Ethereum sitting at a critical junction. There are two resistance zones stacked overhead: the first at $3,450–$3,500 and a deeper one at $3,650–$3,700. ETH needs a strong daily close above $3,500 to confirm momentum. Without that, the current move remains unconfirmed and vulnerable.

If ETH gets rejected here, it could drop quickly. There are three support zones below: $3,320–$3,340, $3,285, and a major demand area at $3,160–$3,170. A failure to hold above $3,450 could send price back toward $3,320, and if selling pressure increases, the $3,160 zone could be tested.

The good news is that buyers have defended the $3,150–$3,300 area strongly. The recent bounce from that lower zone gave ETH the momentum it needed to push back up and retest mid-range resistance. This shows there's active demand at key levels.

What's Behind the Move?

Several factors are supporting Ethereum right now:

- Market confidence from Bitcoin stability: With BTC holding key supports, overall sentiment has lifted across major altcoins.

- Ethereum ETF speculation: Ongoing discussions around ETH ETFs continue to draw liquidity into Ethereum.

- Improving network metrics: Rising activity on Layer-2 networks and growing staking participation have supported ETH's recovery structure.

- Risk asset rebound: Traditional markets are in a relief phase, boosting investor appetite for high-beta assets like ETH.

Key Scenarios

- Bullish path: A daily close above $3,500 strengthens upward momentum and opens the door toward $3,650–$3,700. Holding above $3,320 preserves the bullish structure.

- Bearish path: A rejection near $3,500 triggers a drop toward $3,320. Failure to hold $3,285 accelerates the move lower, and losing $3,160 signals a deeper reversal toward the $3,000 region.

Ethereum's recovery above $3,500 is encouraging, but the real test is whether it can close there on the daily chart. Acceptance above $3,450–$3,500 would confirm bullish momentum, while another rejection could send price back to the mid-$3,200s quickly.

As volatility rises and markets wait for confirmation, ETH traders should stay alert. The next major move is likely to unfold from exactly where we are right now.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov