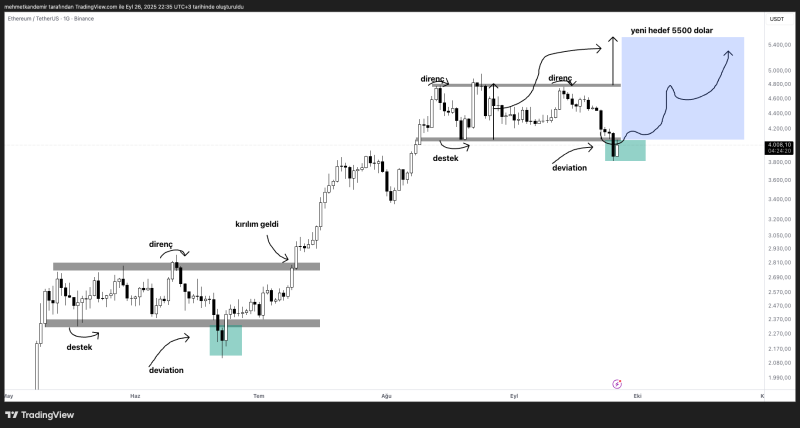

Ethereum just did something traders love to see - it briefly broke below key support only to snap right back up. This "deviation" move around the $3,800-$4,000 zone cleared out overleveraged longs and set the stage for what could be ETH's next big rally.

The Technical Setup

Trader Mehmet Kandemir spotted this setup, and now all eyes are on whether Ethereum can push toward that ambitious $5,500 target.

ETH's recent price action tells a clear story. The brief dip below $3,800 wasn't a breakdown - it was a shakeout. These deviation moves happen all the time in crypto, and they're often the last stop before major rallies kick in. Ethereum is now sitting pretty between that reclaimed $3,800-$4,000 support and the next big resistance wall around $4,600-$4,800.

The path forward looks straightforward but challenging. ETH needs to punch through that $4,800 ceiling with real conviction and volume. If it does, the $5,500 target suddenly becomes very realistic. This isn't just wishful thinking - it's based on how these deviation patterns typically play out in crypto markets.

Why This Rally Makes Sense

The fundamentals are lining up nicely behind this technical picture. Institutional money keeps flowing into ETH staking and derivatives products, creating steady demand pressure. DeFi activity is picking up again, and Layer-2 solutions are driving more on-chain usage than ever before. Add in the broader macro environment where everyone's expecting the Fed to ease up, and you've got a recipe for risk assets like crypto to run higher.

Peter Smith

Peter Smith

Peter Smith

Peter Smith