Ethereum's upward momentum is stalling as traders grow more cautious following a brief push above $3,900. This shift reflects weakening buyer interest near resistance levels and growing expectations for a short-term correction.

Price Action Signals Further Downside

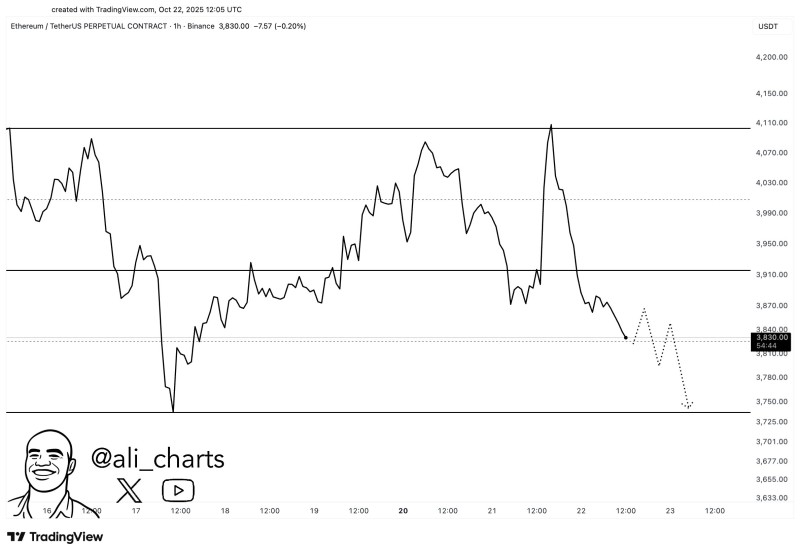

Fresh technical analysis from Ali suggests ETH may be gearing up for another downward move, with the chart indicating a potential retest of $3,700 — an area that previously held as solid support. The 1-hour ETH/USDT chart on Binance shows a concerning weakening pattern. Ethereum is currently hovering around $3,830 after failing to hold gains above $3,910. The projected path outlined on the chart suggests the price may drift lower toward the $3,700–$3,750 range after a brief period of consolidation.

This setup reveals increasing bearish momentum and limited buying interest. The $3,910 level stands as the critical pivot point — only a move back above it would break the current bearish structure.

Critical Price Levels Worth Monitoring

- Immediate Resistance: $3,910

- Current Price: $3,830

- Short-Term Support: $3,750–$3,700

- Major Resistance Zone: $4,100

The chart structure shows a series of lower highs and lower lows, confirming the near-term downtrend remains intact. As long as ETH stays below $3,900, the easier path appears to be downward. A confirmed break under $3,800 could intensify selling pressure and trigger a quick drop toward $3,700.

What's Driving the Weakness?

Ethereum's recent decline stems from a mix of technical and broader market factors. Bitcoin's consolidation near cycle peaks has pulled capital away from altcoins and back into BTC. Uncertainty around Ethereum ETF approvals is keeping traders on edge and adding to volatility. Meanwhile, overextended long positions and elevated funding rates have prompted leveraged traders to lock in profits. On the macro side, rising Treasury yields and a strengthening dollar continue pressuring risk assets across the board, crypto included.

Still, Ethereum's long-term foundation remains solid, with growing staking activity and expanding Layer-2 adoption providing underlying support.

The $3,700 level is crucial for Ethereum's near-term direction. It marks both a previous consolidation area and a high-volume zone where buyers have stepped in before to stop declines.

If ETH manages to hold above this level, it could stabilize and set up a bounce back toward $3,900–$4,000. But a clean break below $3,700 would open the door to deeper losses, potentially reaching $3,650 or even $3,600.

Right now, traders are watching closely to see if this support can withstand the selling pressure or if Ethereum's correction has further to run.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah