Ethereum ETFs, approved on May 24, could amass up to $4 billion in the next five months, significantly boosting the ETH market.

Ethereum ETFs: A $4 Billion Opportunity

Ethereum ETFs, which received approval on May 24, are poised to revolutionize the crypto investment landscape. These digital assets have the potential to generate up to $4 billion within the next five months.

Cryptography experts are optimistic that Ethereum ETFs will mirror the success of Bitcoin ETFs. Projections are based on the current market share of Ethereum assets under management, which stands at 28% relative to Bitcoin. With institutional funds already controlling 3.3% of the circulating ETH supply, anticipates substantial inflows ranging from $3.1 billion to $4.8 billion, equivalent to between 750,000 and 1 million ETH.

Ethereum ETFs vs. Bitcoin ETFs

Ethereum ETFs are closely modeled after Bitcoin ETFs. Since their inception, Bitcoin ETFs have amassed $13.9 billion in the US alone, with over one million BTC under global management, accounting for more than 5% of the circulating BTC supply.

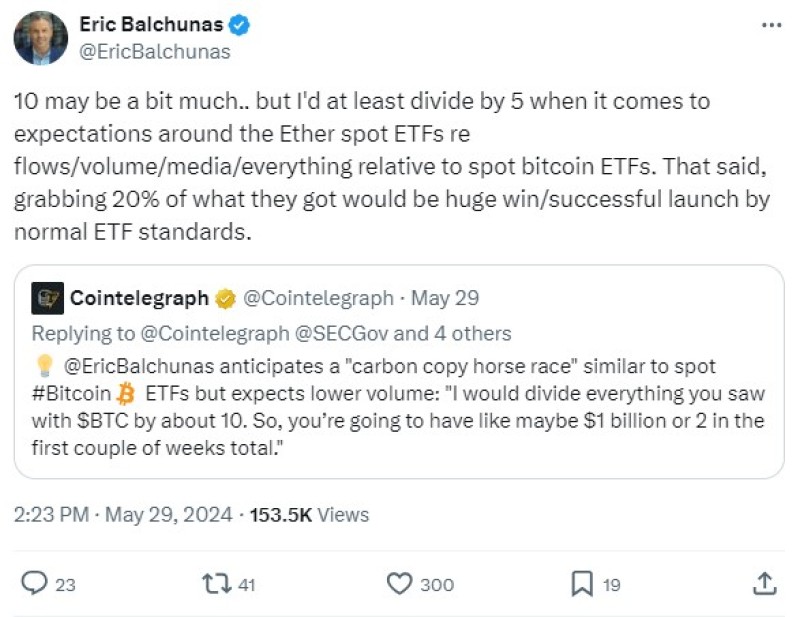

Using the success of Bitcoin ETFs as a benchmark, forecasts for Ethereum ETFs are equally promising. Bloomberg analyst Eric Balchunas predicts that Ethereum ETFs could achieve returns between 10% and 20% of what Bitcoin ETFs have generated. "Recovering 20% would be a huge win," Balchunas remarked in a tweet.

Impact on the Institutional Market

The advent of Ethereum ETFs is expected to fortify Ethereum's standing in the institutional market. ETH futures contracts on the Chicago Mercantile Exchange already represent 23% of Bitcoin's size, indicating robust institutional demand.

Moreover, European and Canadian funds are increasingly showing interest in Ethereum ETFs. These funds currently hold about one-third of the assets under management compared to Bitcoin, signaling a growing appetite for Ethereum investments. This positive trend is likely to drive further institutional adoption of Ethereum.

Conclusion

With predictions of inflows reaching up to $4 billion, Ethereum ETFs are poised to become a cornerstone of crypto investments, standing alongside Bitcoin. As the market evolves, the success of Ethereum ETFs could significantly influence the broader adoption and valuation of Ethereum in the institutional investment sector.

Peter Smith

Peter Smith

Peter Smith

Peter Smith