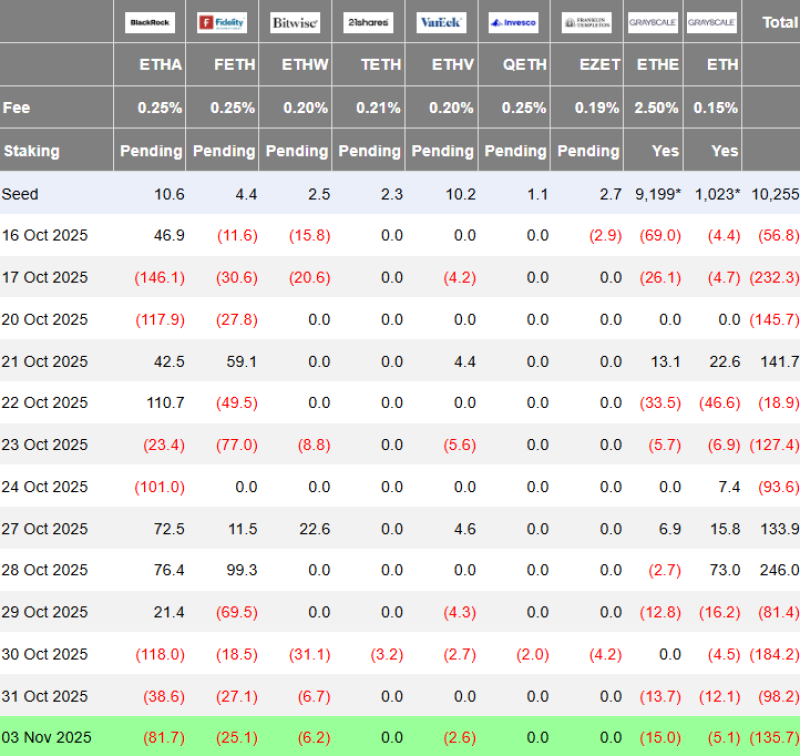

Institutional investors showed a sharp loss of confidence in Ethereum last week. On November 3, 2025, Ethereum-based ETFs recorded combined outflows of $135.7 million, representing one of the largest single-day redemption events since spot ETH funds launched earlier this year. The sell-off has raised questions about whether institutional appetite for the world's second-largest cryptocurrency is cooling off.

Major Outflows Across Leading Ethereum ETFs

The data, initially reported by trader Ted, reveals widespread selling across nearly every major Ethereum exchange-traded product.

BlackRock's ETHA fund saw the heaviest withdrawals at $81.7 million, followed by Fidelity's FETH with $25.1 million in outflows. Other notable redemptions included:

- Grayscale ETHE: $15.0 million

- Bitwise ETHW: $6.2 million

- Invesco EZET: $5.1 million

- VanEck TETH: $2.6 million

These redemptions completely erased the modest gains recorded earlier in the week and pushed total Ethereum ETF assets under management down to roughly $10.1 billion. The breadth of the selling suggests this wasn't isolated profit-taking but rather a coordinated shift in institutional positioning.

From Recovery to Reversal

Just days earlier, the picture looked very different. Between October 27 and 28, Ethereum ETFs attracted over $370 million in fresh capital as sentiment briefly improved. But that momentum evaporated quickly. By the end of October, the market had already recorded two consecutive days of outflows exceeding $90 million each. The November 3 data confirmed that institutions were pulling back across the board, not just from a single issuer or product.

Why Institutions Are Stepping Back

The sudden reversal appears to be driven by several converging factors. Ethereum's price has struggled to maintain support above $3,000, weighed down by lackluster on-chain activity and subdued interest in decentralized finance protocols.

At the same time, rising bond yields and a more cautious tone from the Federal Reserve have made traditional safe-haven assets more attractive, pulling capital away from riskier investments like crypto. Many large institutions also rebalance their portfolios toward year-end, either locking in gains or adjusting exposure to manage regulatory capital requirements. While the outflows reflect near-term caution, they don't necessarily signal a permanent retreat from Ethereum as an asset class.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov