The anticipated approval of the spot Ethereum ETF could significantly impact the crypto market, influencing prices and paving the way for future ETF products.

Anticipation Grows for Ethereum ETF Approval

Since May, the crypto community has eagerly awaited the approval of the S-1 registration for the spot Ethereum ETF. Market experts have speculated extensively on the timing of the product's launch. According to ETFStore President Nate Geraci, there is no reason to believe the Ethereum ETF won't go live this week, fueling excitement and anticipation.

Prospective Ethereum ETF issuers have made necessary amendments to their S-1 registration forms to satisfy the United States Securities and Exchange Commission (SEC). These adjustments, reminiscent of the compromises seen during the spot Bitcoin ETF approval process, have bolstered market confidence, with no further delays expected.

Potential Market Impact of Ethereum ETF Trading

The primary concern among industry stakeholders is the potential impact of the Ethereum ETF on the broader market. When the SEC approved 19b-4 filings in May, the crypto market experienced a significant price surge, affecting Bitcoin and various altcoins. Although this rally was brief, a similar market reaction is anticipated when the Ethereum ETF begins trading.

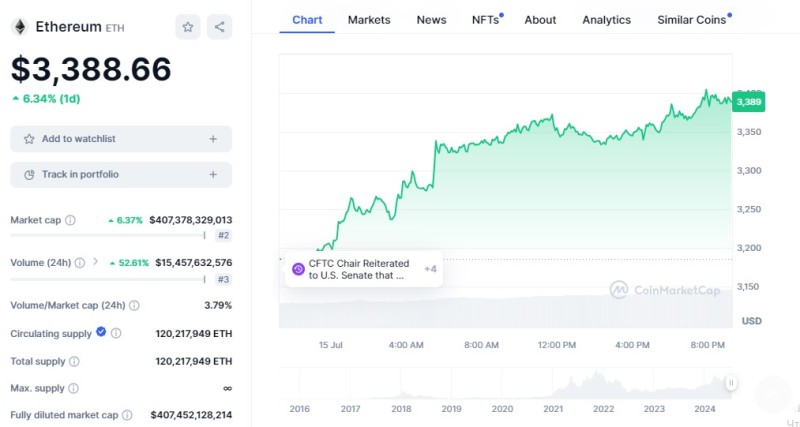

Currently, Ethereum's price and trading volume have seen substantial increases, with a 6.34% rise in price to $3,388.66 and a 52.61% spike in trading volume to $15,457,632,576. This bullish sentiment reflects growing investor confidence in the impending ETF launch. Besides the immediate price impact, the Ethereum ETF's approval could set a precedent for other altcoins seeking similar acceptance on Wall Street.

Future of Crypto ETFs Beyond Ethereum

The approval and trading of the Ethereum ETF might validate the market's demand for regulated crypto products. Following Ethereum, there are active applications for a Solana ETF by VanEck and 21Shares' push for a Bitcoin and Ethereum duopoly product. Looking ahead, the market might witness the introduction of ETFs for other cryptocurrencies, such as Shiba Inu and XRP.

In conclusion, as the crypto market braces for the Ethereum ETF's approval, the potential implications are vast. From price movements to the broader acceptance of altcoin ETFs, this development could mark a significant milestone in the evolution of crypto investments. Investors and market participants will be keenly observing the ETF's launch and its subsequent impact on the crypto landscape.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah