Ethereum's rally toward $5,000 has stalled as investors dump over $2 billion worth of ETH onto exchanges. The altcoin king now faces a potential crash below critical support levels.

ETH Price Under Pressure as Whales Cash Out

Ethereum's dream run toward the $5,000 milestone has hit a brick wall. After failing to break through earlier this month, ETH is now struggling to stay above $4,500 as selling pressure mounts across the board.

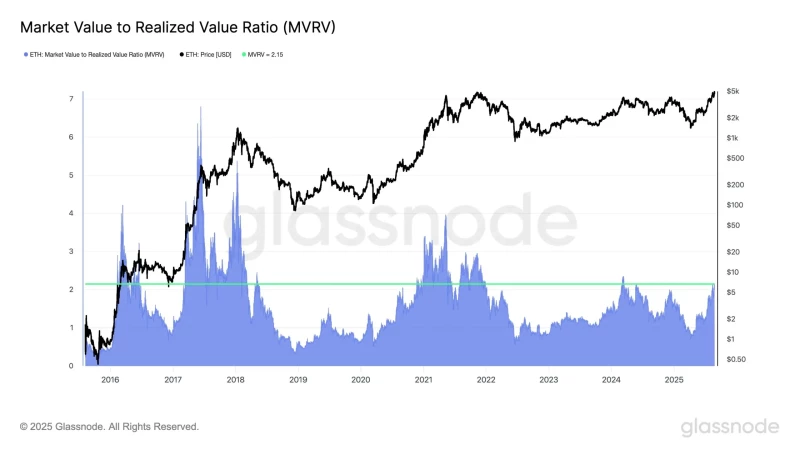

The numbers don't lie – we're seeing a classic profit-taking scenario unfold. The MVRV ratio has climbed to 2.15, meaning average holders are sitting on 115% unrealized gains. History shows us what happens next: when this metric hits these levels, major corrections usually follow. We saw the same pattern in March 2024 and December 2020, both times leading to significant price drops.

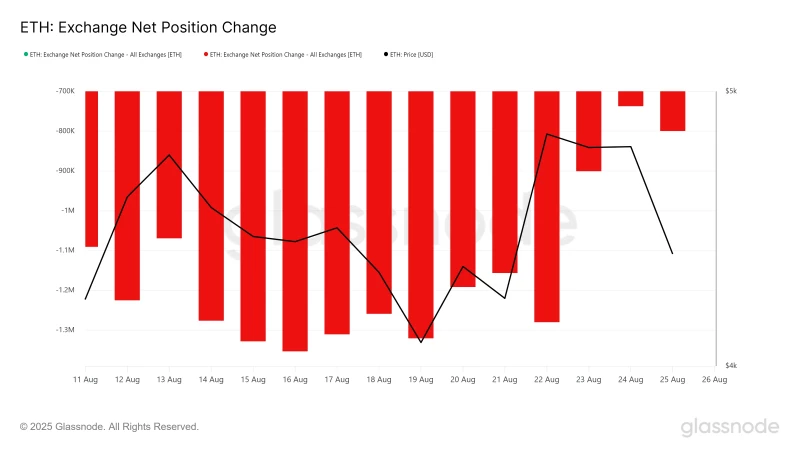

What's really concerning is the exchange flow data. In just the past week, investors have moved 521,000 ETH (worth over $2.3 billion) to centralized exchanges. T

hat's not accumulation – that's preparation for a massive sell-off. When whales start moving this much ETH to exchanges, it's rarely good news for the price.

Ethereum (ETH) Technical Analysis Points to $4,000 Target

Right now, ETH is trading at $4,433, sitting uncomfortably below the $4,500 resistance that it just can't seem to break. The fact that bulls can't reclaim this level as support is telling us everything we need to know about the current weakness.

The charts are painting a pretty clear picture. If ETH breaks below the $4,222 support level – which looks increasingly likely given the selling pressure – we could see a swift drop to $4,007. That's roughly a 10% decline from current levels, but it would align perfectly with what the on-chain data is telling us.

ETH Price Prediction: Bulls Need a Miracle

The outlook for Ethereum isn't looking great in the short term. With over $2 billion worth of ETH ready to hit the market and profit-taking behavior at historically high levels, the path of least resistance appears to be down.

However, crypto markets can surprise us. If buying pressure suddenly emerges and ETH manages to hold above $4,222, we could see a bounce back toward $4,500 and potentially $4,749. But given the current setup, that scenario seems less probable.

Ethereum holders should brace for potential turbulence ahead. The combination of elevated MVRV ratios and massive exchange inflows has historically led to significant corrections. Unless something changes quickly, ETH's journey to $4,000 might be closer than many investors think.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah