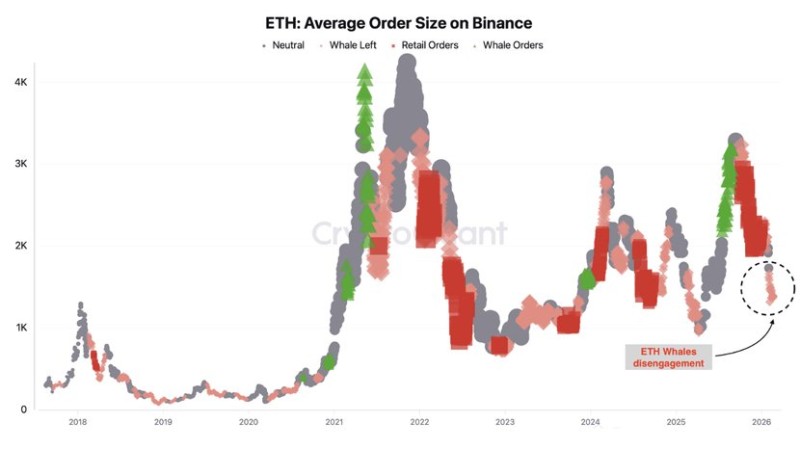

⬤ Ethereum has been stuck in a tight range far below its all-time high, with sluggish price action despite recent volatility. What's happening beneath the surface tells a different story - liquidity is thinning as big players pull back. Binance data shows whale order sizes dropping consistently, meaning less market depth even though retail traders are still active.

⬤ The numbers are clear. On February 19, Ethereum spot ETFs saw roughly $130 million flow out - one of the biggest exits this year. Meanwhile, average order sizes on Binance keep trending lower, suggesting whales are backing away. Charts tracking this over several years show whale orders that once dominated now sliding down. "When large participants step back and average order sizes shrink, markets can become more sensitive to directional flows," analysts noted. This pullback means less cushion to absorb selling pressure, potentially creating what traders call a "volatility coil."

⬤ Here's where it gets interesting - retail volume is holding steady, but smaller orders alone might not be enough to soak up any serious selling. This creates two possible scenarios: either big liquidity providers come back in and help push prices higher, or thin order books end up magnifying moves to the downside if sellers start unloading. For context on how ETH has been navigating recent zones, check out Ethereum Price Holds Key Support Amid Momentum Pullback, which covers near-term support behavior, ETH Price Outlook: Next Resistance Levels in Focus.

Usman Salis

Usman Salis

Usman Salis

Usman Salis