Ethereum (ETH) just faced its second-biggest selling wave of 2025, but whales keep buying the dip. Despite massive exchange inflows, ETH bulls refuse to give up their $5,000 dreams.

ETH Faces Second-Largest Selling Wave of 2025

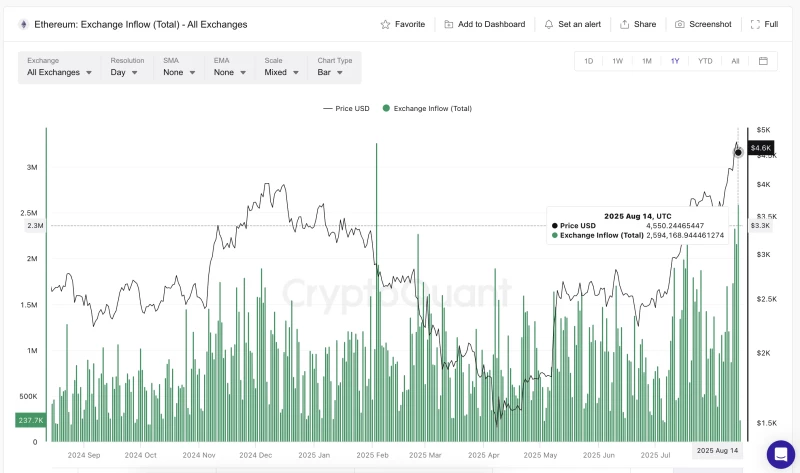

On August 14, Ethereum saw 2,594,168 ETH pour into exchanges — roughly $8 billion in selling pressure. This marks the second-highest single-day exchange inflow of 2025, only beaten by February 3's 3,264,688 ETH spike.

Exchange inflows usually mean selling, and much came from Ethereum Foundation wallets. Back in early 2025, similar spikes crushed prices during downtrends. But these recent waves on July 18 (2,381,361 ETH) and August 12 (2,335,642 ETH) happened during an uptrend — bulls are absorbing all that selling pressure.

Ethereum (ETH) Whales Keep Buying the Chaos

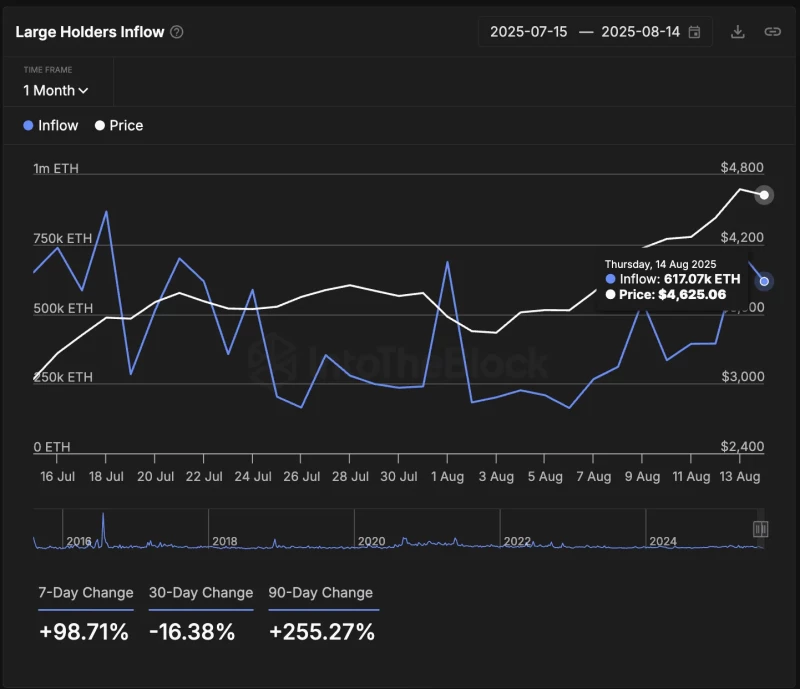

While others panic, smart money is buying more. Large holders (wallets with 0.1%+ of total supply) increased inflows +98.71% in seven days and +255.27% over 90 days.

When ETH dropped from $3,781 to $3,577 between July 31-August 1, whale buying jumped from 240,190 ETH to 687,290 ETH overnight. The numbers peaked at 725,000 ETH on August 13 and hold strong above 617,000 ETH. Big players still think ETH is cheap.

ETH Price Holds Strong — $5K Still Possible

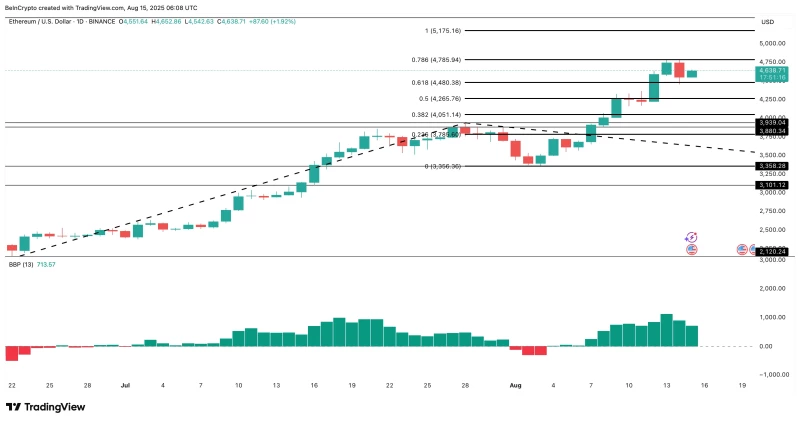

ETH is holding $4,480 support like a rock. Break $4,785 resistance, and we're looking at a run toward $5,000 ($5,175 technically). The bull-bear indicator still favors buyers despite all the exchange inflows.

For bears to win, ETH needs to lose $4,480 support while exchange inflows surge and whale buying stops. None of that's happening yet.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah