Ethereum finds itself at a critical juncture as traders watch key support levels with bated breath. With nearly 690,000 ETH tokens creating a fortress-like accumulation zone at $4,260, the cryptocurrency market is witnessing a high-stakes battle between bulls and bears that could determine ETH's next major move.

ETH Digs In at Crucial Support Level

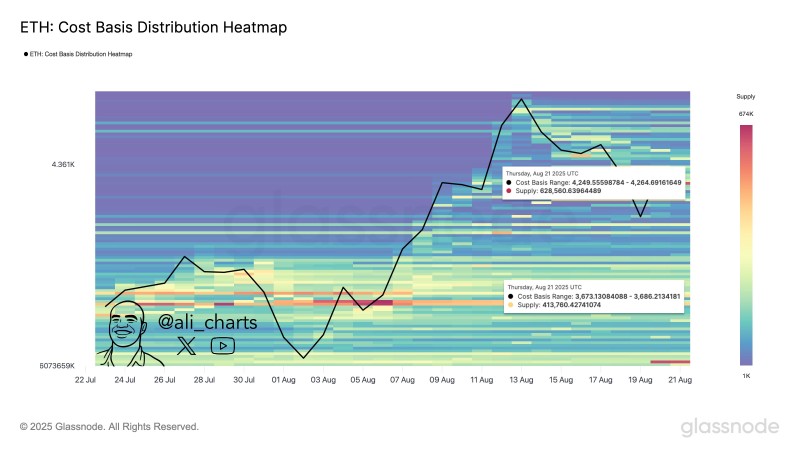

Right now, Ethereum is playing defense around the $4,260 mark, and it's not going down without a fight. As noted by well-known Famous Trader, the numbers tell a compelling story – almost 690,000 ETH have been scooped up at this price point, creating what looks like a pretty solid foundation based on the latest cost basis distribution data.

This isn't just any random price level we're talking about. When you see this kind of accumulation, it usually means serious money is stepping in, treating this zone like a bargain bin. If the buyers can keep their ground here, we might see ETH bounce back and start climbing toward those higher resistance levels that have been taunting traders for weeks.

The $3,700 Safety Net – Will It Hold If Things Go South?

Here's where it gets interesting though. Nobody's pretending that support levels are unbreakable, and if $4,260 gives way, traders aren't just throwing in the towel. They've got their eyes locked on $3,700 as the next line in the sand.

The data backs this up too – over 413,000 ETH were previously accumulated around that $3,700 zone, making it the logical next stop if things head south. It's like having a safety net under the high-wire act, though nobody really wants to test whether it'll hold.

A breakdown below $4,260 would definitely shake confidence and could trigger some serious selling pressure. But here's the thing – if ETH can hold its ground above this support level, it actually strengthens the argument for another push higher. Sometimes the market just needs to test these levels to prove they're real before making the next move up.

Usman Salis

Usman Salis

Usman Salis

Usman Salis