The cryptocurrency market is witnessing unprecedented whale activity in Ethereum, with institutional accumulation reaching remarkable levels. Recent data reveals that major entities have collectively purchased over 2 million ETH in the past two months, signaling strong institutional confidence in Ethereum's future prospects.

Aggressive ETH Accumulation Strategy

The crypto community has been closely watching Bitmine's extraordinary buying spree, which saw the entity accumulate 276,800 ETH during the first half of September alone.

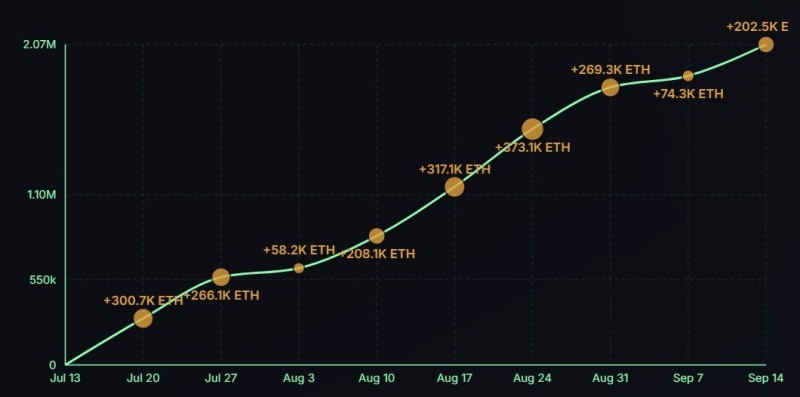

According to Solix Trading analysis, this aggressive purchasing pattern began in mid-July and represents one of the year's most significant single-entity Ethereum acquisitions.

The accumulation data reveals several major purchase milestones: 300,700 ETH added on July 20, followed by 373,100 ETH on August 24, and another substantial 269,300 ETH on August 31. By September 14, Bitmine's total holdings exceeded 2.07 million ETH, demonstrating unwavering commitment to Ethereum's long-term value proposition.

Technical Analysis Shows Sustained Buying Pressure

The accumulation pattern displays clear exponential growth characteristics, with weekly inflows frequently surpassing 200,000 ETH. Even during relatively quiet periods in early August, purchases maintained steady momentum with average weekly inflows exceeding 50,000 ETH. This sustained buying activity has coincided with ETH's ability to maintain support above the $3,000 price level, suggesting that whale confidence is helping stabilize the market during volatile periods.

Market Drivers Behind Ethereum Accumulation

Several fundamental factors are contributing to this institutional buying wave. Anticipated ETH ETF approvals in major financial markets could potentially replicate the significant inflows seen with Bitcoin ETFs earlier this year. Additionally, Ethereum's post-merge deflationary mechanics continue to reduce token supply through ongoing burns, creating favorable supply-demand dynamics.

The growing staking ecosystem, led by platforms such as Lido, Coinbase, and Kraken, has transformed ETH into a yield-generating asset, attracting income-focused institutional investors. Meanwhile, Ethereum's dominant position in decentralized finance and the expanding tokenization sector reinforces its utility as the primary blockchain for smart contract applications.

Market Implications and Future Considerations

The $1.3 billion worth of ETH accumulated in just two weeks represents a powerful vote of confidence from sophisticated market participants. If this accumulation trend persists, Ethereum could experience sustained upward price pressure, particularly if retail investor interest begins to match institutional enthusiasm.

However, market participants should remain aware that concentrated whale positions can introduce volatility risks if large holders decide to take profits simultaneously. Currently, the overwhelming accumulation trend suggests that major players view current price levels as attractive entry points for long-term positions, painting an optimistic picture for Ethereum's near-term trajectory.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah