Ethereum (ETH) jumped nearly 10% this week as exchange supply hits yearly lows and institutional money flows back in, setting up what could be a massive breakout toward $5,000.

ETH Price Gets Boost from Supply Crunch

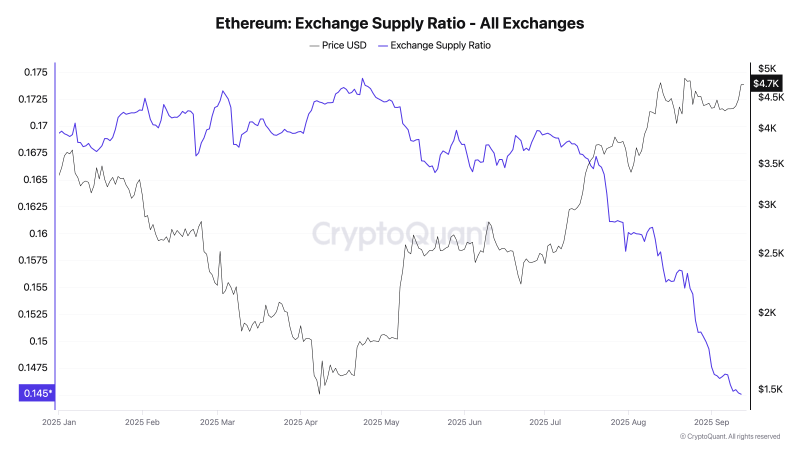

Ethereum just shot up almost 10% over the past week, and it's not just another random pump. The Exchange Supply Ratio (ESR) hit its lowest point all year at 0.14, down consistently since July 20, per CryptoQuant data.

When people pull their ETH off exchanges into cold storage, it usually means they're not selling anytime soon – and fewer coins available means any buying pressure pushes prices up faster.

Smart Money Returns to ETH as Price Targets $5,000

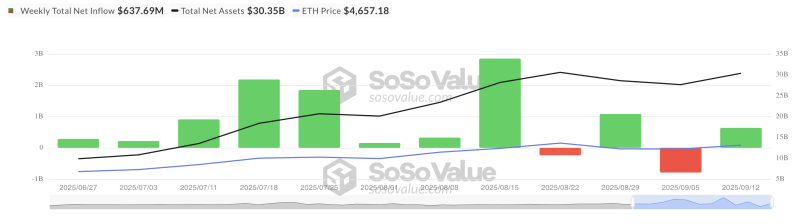

The institutions are coming back hard. Those Ethereum ETFs that were bleeding money last week just flipped completely.

Between September 8-12, spot Ethereum ETFs pulled in $638 million in fresh cash, according to SosoValue – a massive turnaround from the $788 million that walked out the week before. When both retail hodlers and institutions are bullish, prices usually do interesting things.

ETH Price Setup Points to $5,000 Breakout

ETH is holding strong above $4,664 support right now. If it keeps defending this level, we're looking at a run back to the all-time high around $4,957. Break above that, and $5,000 becomes the obvious target.

Of course, if ETH loses $4,664 support, the next stop is around $4,211. But with exchange supplies this tight and institutional money flowing back in, the setup looks pretty bullish.

Usman Salis

Usman Salis

Usman Salis

Usman Salis