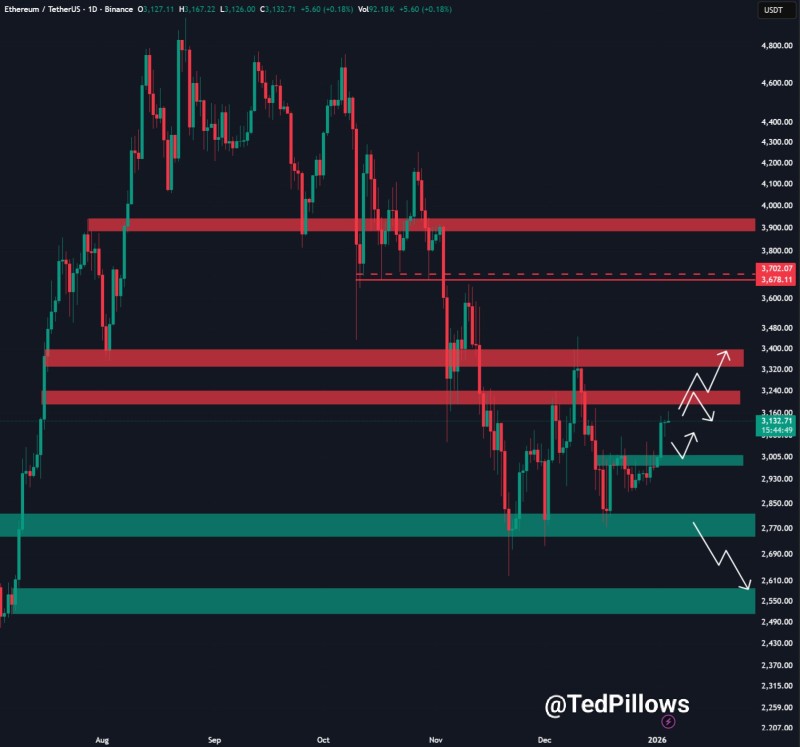

⬤ Ethereum is holding firm above the $3,000 support zone, currently trading between $3,140 and $3,150 on the daily chart. This price level has become a clear demand region after ETH recovered from recent weakness, and now all eyes are on whether it can push back above $3,200. The $3,000 mark is acting as a solid floor for price action, keeping Ethereum stable in the short term.

⬤ The $3,200 area represents the next major hurdle, with previous price action showing multiple reactions between $3,200 and $3,350. If Ethereum manages to reclaim this zone, there's potential for a 10-15% rally from current levels. "If Ethereum is able to reclaim this zone, the potential for a 10 to 15 percent rally from current levels becomes realistic," according to the analysis. That would put possible targets somewhere between $3,500 and $3,700, depending on momentum and market conditions.

⬤ Below current prices, there are additional support zones that could come into play if ETH faces selling pressure. The first sits between $2,900 and $2,950, with a more significant zone located in the $2,600-$2,700 range. These areas have historically attracted buyers when Ethereum pulled back, creating a defined structure of support and resistance levels that frame the current price action.

⬤ How Ethereum behaves around these key levels will likely shape near-term market sentiment. Holding $3,000 keeps the consolidation phase intact and suggests underlying strength, while breaking above $3,200 would signal improving momentum and potentially attract fresh buying. On the flip side, losing the $3,000 support could shift focus back to those lower demand zones, making these price boundaries critical to watch in the coming sessions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis