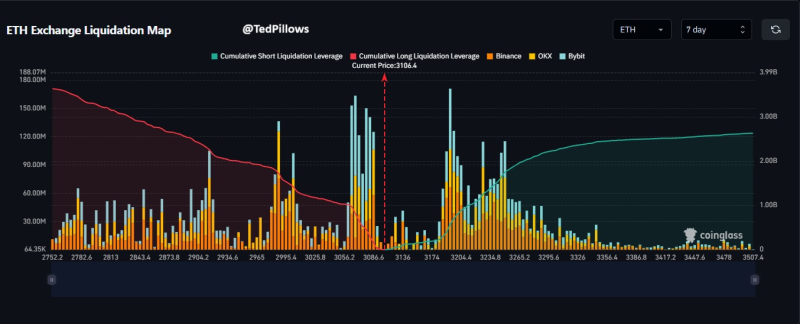

⬤ Ethereum now sits in a danger zone - fresh liquidation data reveal that huge leverage has piled up near the $3,106 mark. A modest 10 % move up or down would force exchanges to close billions in positions. The liquidation map shows that leveraged bets cluster tightly leaving trading conditions brittle.

⬤ The figures speak plainly. If ETH rises only 10 %, about $2.51 billion in short positions will be liquidated. The short liquidation curve climbs steeply above $3,300 - $3,500, which shows that many traders have staked on lower prices. OKX besides Bybit each hold large short positions across that zone.

The liquidation map displays dense blocks of leverage and shows how finely balanced Ethereum trading has become.

⬤ The downside looks still more fragile. If Ethereum falls 10 %, roughly $3.3 billion in long positions will face liquidation. Long contracts concentrate between $3,000 and $2,800 - a drop of that size would set off a larger cascade than a rally of the same size. Both directions carry risk - yet longs below the current price look more exposed.

⬤ Mass liquidations can drive violent moves and erode confidence across crypto. Because Ethereum now carries heavy leverage on both sides, even routine volatility can drain liquidity quickly. Any clear break from the present range will probably decide the next move.

Peter Smith

Peter Smith

Peter Smith

Peter Smith