Big ETH whales just quietly bought $114 million worth of tokens while everyone else is selling, suggesting a major price move could be coming soon.

While everyone's complaining about ETH's price action, some very smart money is doing the opposite – they're buying. And we're not talking small amounts here. One whale just dropped $114 million on Ethereum in less than 30 hours, and they're not alone.

This is classic crypto behavior. When retail traders are panicking and selling, the big players swoop in and load up their bags. The difference this time? It's happening across the board – whales, institutions, ETF flows – everyone with serious money seems to be betting on ETH going up.

According to Lookonchain, wallet 0xF436 (likely tied to DeFiance Capital) grabbed 30,366 ETH worth $114 million in just 28 hours. That's not casual buying – that's "I know something you don't" level accumulation.

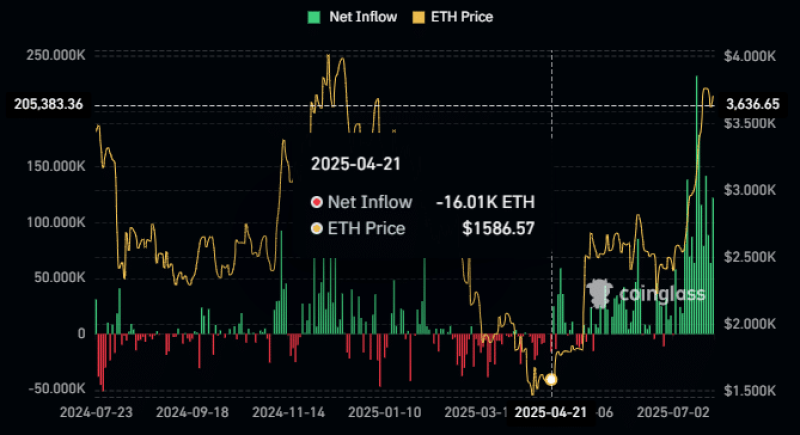

What makes this even more interesting is the timing. CoinGlass data shows Ethereum ETFs are pulling in strong inflows again, even though regular folks are basically done with spot trading. When institutions start moving like this while retail sits on the sidelines, something big usually follows.

ETH (Ethereum) Big Players Keep Buying Despite the Mess

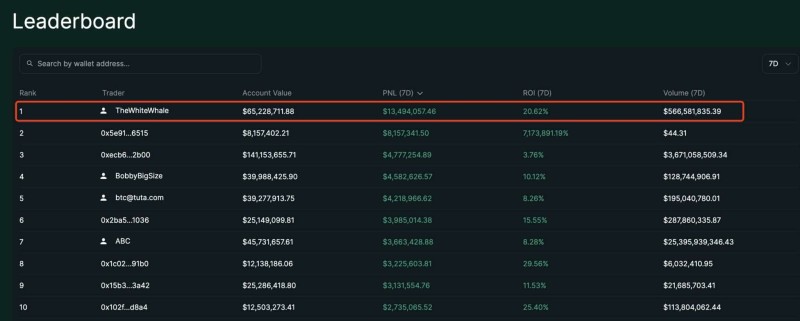

The whale action isn't stopping with one massive purchase. Top trader TheWhiteWhaleHL is still sitting at the top of the leaderboard with 48,405 ETH in open long positions – that's $181 million on the line with about $33 million in unrealized profits.

Here's what's crazy: this trader held through all the recent liquidations and volatility. Most people would've cut their losses, but this whale actually scaled up. That kind of conviction doesn't come from hope – it comes from having information or analysis that retail traders just don't have.

The pattern is showing up everywhere. AMBCrypto's analysis of whale activity and spot ETF net inflows points to rising mid-term confidence, even while the 30-day Spot Cumulative Volume Delta shows we're still in "everyone's selling" mode.

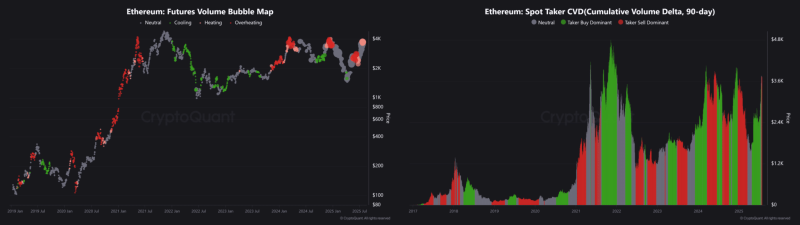

ETH (Ethereum) Futures Market Gets Hot While Spot Stays Cold

This is where things get really weird. The spot market is a bloodbath – people are dumping ETH like it's going out of style. But flip over to futures, and it's a completely different story.

CryptoQuant's Futures Volume Bubble Map shows things are heating up fast. Leverage is climbing, volume is building, and derivatives traders are positioning for something big. Meanwhile, spot traders are still stuck in sell mode.

This kind of split usually means one thing: the smart money is setting up for a squeeze while everyone else is still fighting yesterday's battle. When spot supply starts drying up and futures volume explodes, price tends to move fast and catch people off guard.

The setup is pretty textbook. You've got persistent selling in spot keeping the price down, but underneath all that noise, institutional money is flooding in. If this pattern plays out like it has before, we could see the bulls regain control pretty quickly.

Bottom line: when whales are dropping $114 million in single days while futures volume heats up, something's probably about to happen. And based on where the smart money is positioning, that something might be bullish for ETH.

Usman Salis

Usman Salis

Usman Salis

Usman Salis