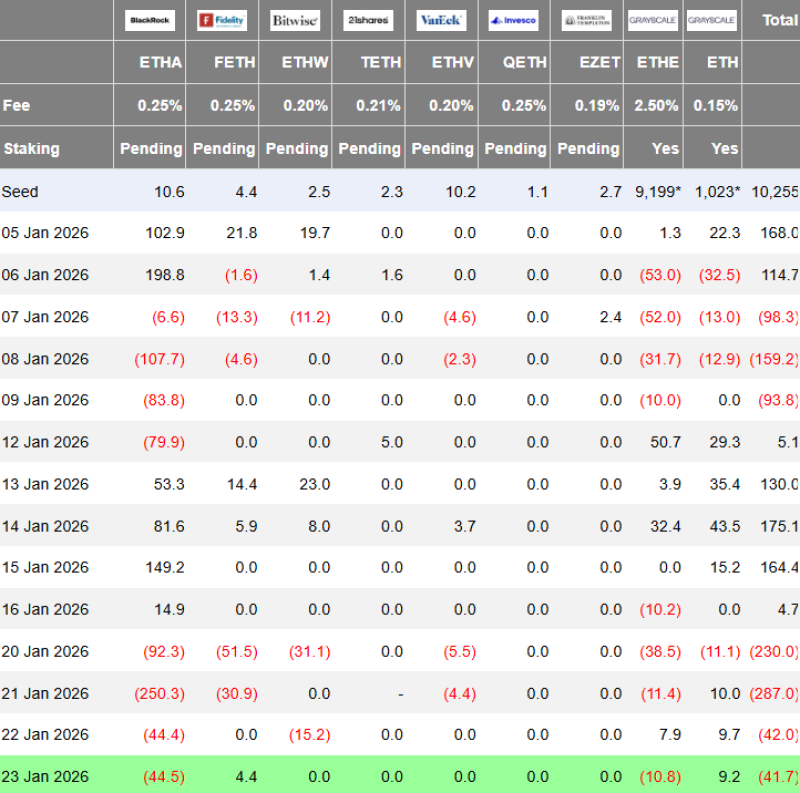

⬤ Ethereum spot ETFs got hit hard last week, bleeding roughly $600.7 million in net outflows. The selling pressure built steadily throughout the week, with redemptions piling up across multiple days rather than hitting all at once. This marks one of the sharpest weekly drawdowns since these products started trading.

⬤ BlackRock's ETHA fund drove most of the damage, dumping around $431.5 million worth of ETH. Fidelity, Bitwise, 21Shares, VanEck, and Grayscale also saw money leave, though their outflows were notably smaller. The flow data shows red ink across several consecutive sessions, making it clear this wasn't just a one-day panic but sustained withdrawal activity.

⬤ What's interesting here is that the money didn't rotate between competing ETH funds—it just left entirely. On days when some funds saw redemptions, others mostly sat flat with little to no fresh capital coming in. That pattern suggests investors were reducing their Ethereum exposure altogether, not just switching between products. Since most of these ETFs still don't offer staking, those withdrawals mean actual ETH holdings dropped without any yield mechanism to soften the blow.

⬤ For the broader crypto market, this matters because ETF flows have become a key read on institutional sentiment. When a major player like BlackRock pulls back this aggressively, it can shift short-term supply dynamics and weigh on market mood. The lack of offsetting inflows points to hesitation rather than tactical repositioning. Whether this selling pressure eases up or continues will be a major signal for where institutional demand is headed next.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov