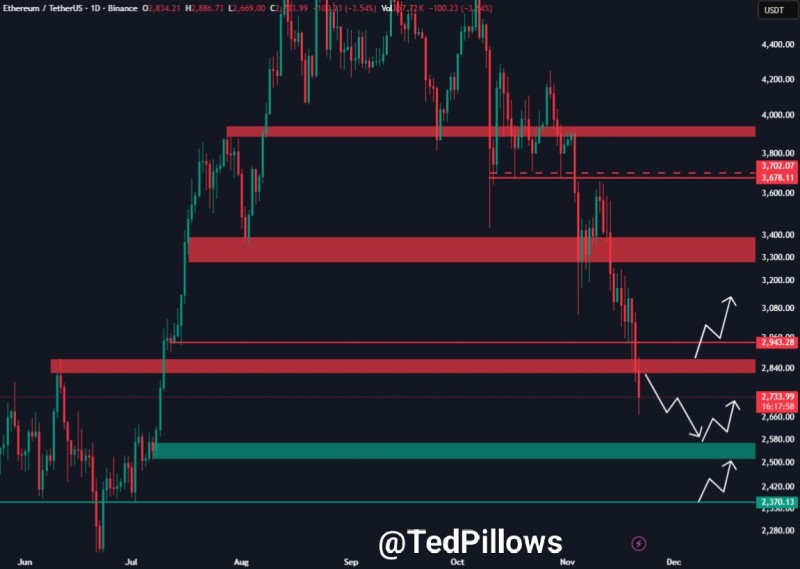

⬤ Ethereum is facing selling pressure after losing the $2,800 support zone and sliding into the $2,650 area. ETH briefly dipped into this lower range before trying to stabilize. The breakdown below $2,800 opened a path toward deeper support clusters, with price now moving around levels last seen earlier in the summer. This shift shows deteriorating short-term momentum after multiple rejections near $3,800.

⬤ The chart shows several critical zones. The former $2,800 support is now acting as resistance, marking where ETH failed to hold its previous base. Above that, a wider resistance block around $3,300 to $3,800 remains in place, representing where the prior rally lost steam. Below current levels, the $2,580 to $2,600 region stands as the next demand area, with deeper support near $2,370 marking the final major liquidity cluster. The move down through $2,800 accelerated quickly, forming a sharp wick toward $2,650 before the market tried rebounding toward $2,940.

⬤ Two potential scenarios emerge from here. One shows ETH climbing back toward the $2,800 resistance zone and attempting a recovery structure. Another shows a failure to reclaim $2,800, with price cycling lower into the $2,580 range before testing deeper support at $2,370. ETH has historically reacted strongly when interacting with these zones. The current sideways movement near $2,700 signals indecision as the market waits to see whether the breakdown will extend or reverse.

⬤ The loss of the $2,800 support level marks an important shift in market sentiment. Whether ETH can reclaim $2,800 may influence short-term dynamics across the broader crypto market, especially given Ethereum's role as a high-volume asset. With clear supply and demand clusters in view, the next moves could shape expectations during this period of elevated volatility.

Usman Salis

Usman Salis

Usman Salis

Usman Salis