Dogecoin (DOGE) is back in the spotlight as on-chain data exposes a significant gap in its price distribution. With two major supply clusters sitting around $0.07 and $0.20, the empty space between them is raising eyebrows among traders who know that markets tend to fill these kinds of voids - sometimes violently.

What the Chart Shows

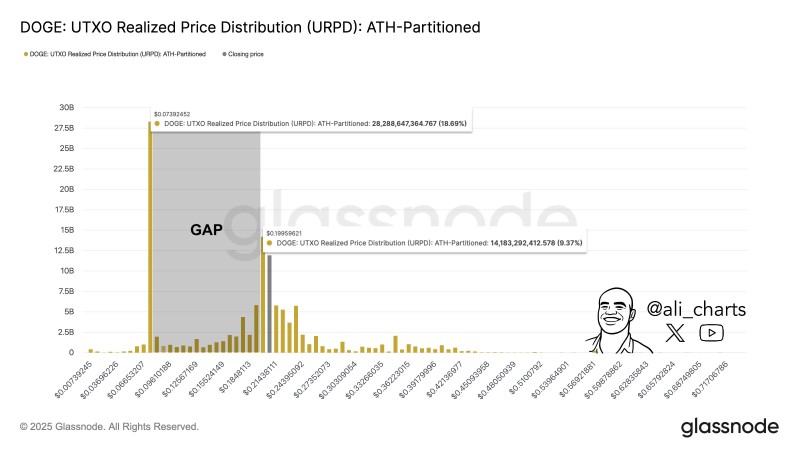

Blockchain analyst Ali recently highlighted data from Glassnode showing DOGE's UTXO Realized Price Distribution.

This metric tracks where holders last moved their coins, essentially mapping out the "memory" of the market. The findings are striking:

- Heavy accumulation near $0.07: About 28.3 billion DOGE (18.7% of supply) sits clustered at this level

- Strong resistance at $0.20: Roughly 14.1 billion DOGE (9.4%) is concentrated here

- The void in between: From $0.07 to $0.19, there's barely any realized activity—leaving this range structurally fragile

When a chart shows this kind of imbalance, it often means one thing: the price may eventually gravitate back toward the gap to establish equilibrium. It's not a guarantee, but it's a pattern traders have learned to respect.

Why This Matters

This gap creates a dual scenario that swing traders and holders should watch closely. If DOGE can hold above $0.20, it signals genuine strength and could lay the groundwork for sustained upward momentum. Buyers would have successfully defended a key threshold, and the market could build from there. But if support cracks, the lack of price history between $0.19 and $0.07 could turn a pullback into a freefall. Without much trading activity in that range, there's little to slow the descent.

Dogecoin has always been driven by hype cycles and speculative bursts, often amplified by social media trends and broader crypto market liquidity. That makes structural weaknesses like this gap even more relevant right now. With meme coins seeing renewed interest and capital rotating across altcoins, understanding where support actually exists - and where it doesn't - can make the difference between catching a bounce and catching a knife.

Peter Smith

Peter Smith

Peter Smith

Peter Smith