Dogecoin (DOGE) has caught the attention of traders once again, not just for its meme-coin status, but for a remarkably consistent pattern that's been playing out over the past several months. The cryptocurrency appears to be following a predictable 42-day cycle of pullbacks and recoveries, and if history repeats itself, we might be on the verge of another significant rally.

What the Charts Are Telling Us

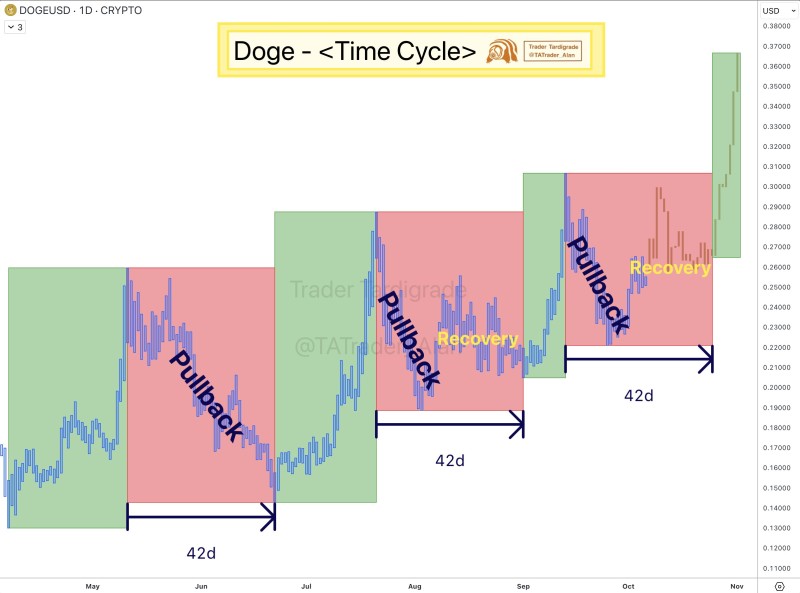

Analyst Trader Tardigrade recently pointed out this intriguing pattern in a tweet, showing how DOGE has been dancing to the same rhythm since May: a six-week pullback, a recovery phase, and then a strong upward push. Right now, the signs suggest Dogecoin is positioning itself for the next leg up in this cycle, potentially setting the stage for a bullish breakout.

When you look at the DOGE/USD daily chart, the pattern becomes pretty clear. Every 42 days or so, we see a corrective phase that lasts about six weeks, followed by a recovery period where the price finds its footing again, and then comes the fun part—a strong upward move. This cyclical behavior has been surprisingly consistent since May, creating a rhythm that traders have started to recognize and act on.

At the moment, DOGE seems to be wrapping up its recovery stage, which historically has been followed by a breakout. If the pattern holds, we could be looking at a move toward the $0.35 to $0.37 range in the coming weeks.

Why This Pattern Matters

There's something interesting about how Dogecoin moves. Much of its price action is driven by retail investors who tend to get excited after watching the price consolidate and recover from a dip. This psychological element creates a self-reinforcing cycle—when traders spot these recurring patterns, they position themselves accordingly, which in turn helps the pattern continue.

Beyond just the technical setup, there's also the broader market context to consider. When Bitcoin shows strength and the overall crypto market sentiment is positive, meme coins like Dogecoin often catch a bid. The combination of technical patterns and market psychology can create powerful momentum.

Support sits around the $0.21 to $0.22 zone, which is where DOGE has consolidated during previous cycles. This area has held up well and acts as a floor for the current structure. On the upside, $0.30 is the first major hurdle to clear. If DOGE can punch through that level with solid volume, it would confirm the bullish continuation and open the door to $0.35, which aligns nicely with the projected cycle target. The key thing to watch for is momentum—specifically, whether we get a clean break above $0.30 accompanied by strong buying volume.

Peter Smith

Peter Smith

Peter Smith

Peter Smith