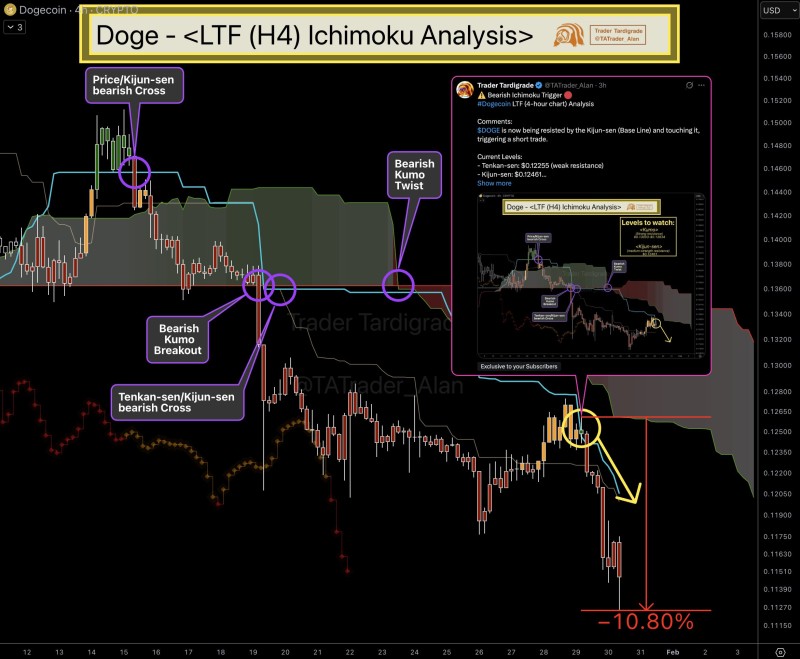

⬤ Dogecoin's rally came to an abrupt halt when it failed to push past a crucial resistance level marked by the Ichimoku Kijun-sen baseline on the H4 chart. The rejection happened right at this technical threshold, where sellers stepped in aggressively. A short position was triggered on the retest, and DOGE proceeded to slide more than 10% from that point.

⬤ The setup showed several bearish Ichimoku confirmations stacking up at once: a Price/Kijun-sen bearish cross, a Kumo breakout to the downside, a Tenkan-sen/Kijun-sen bearish cross, and a bearish Kumo twist. These signals suggest the downtrend is gaining strength rather than losing steam, with price staying firmly below the cloud throughout the selloff.

⬤ Before the rejection, DOGE had been trading sideways below the cloud. Once the Kijun-sen resistance held firm, downside pressure picked up quickly, driving the coin down toward the $0.115 zone. The measured decline from the short trigger came in at roughly 10.8%, confirming the momentum shift after the bearish signal.

⬤ This move matters beyond just DOGE. Dogecoin often reflects broader sentiment in speculative crypto markets. When it weakens with strong technical confirmation like this, similar altcoins tend to follow. How price behaves around these key levels could influence short-term volatility and direction across the wider market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah