Dogecoin is gaining serious attention as major holders accumulate positions and new ETFs open institutional doors. Trading within a rising channel pattern, the meme coin shows technical signs of preparing for its next significant move higher.

Market Developments

Recent on-chain data reveals 122 million DOGE tokens moved off exchanges into cold storage, indicating whale accumulation. This type of large-holder activity typically reduces selling pressure while signaling long-term confidence in the asset's prospects.

Meanwhile, newly launched Dogecoin ETFs are providing institutional investors their first regulated pathway to DOGE exposure. For a cryptocurrency built on retail enthusiasm, this institutional legitimacy marks a notable evolution. As trader MosesMee noted, these combined factors could serve as key catalysts for higher valuations.

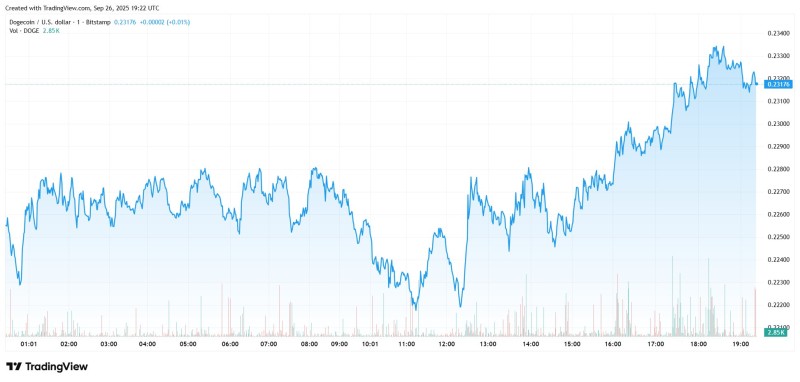

The technical picture supports this optimism. Dogecoin has been consolidating between $0.21-$0.22 within a rising channel, with strong support consistently emerging at $0.22. The RSI remains neutral-to-bullish without showing overextension, while gradually increasing volume suggests growing demand. Currently trading above $0.2317, DOGE appears positioned for a move toward $0.25 if momentum continues.

The $1 Question

While $1 price targets have long been part of Dogecoin's narrative, current conditions offer more substance than previous hype cycles. Institutional flows, ecosystem developments like Dogechain, and improving market structure create a more solid foundation. However, broader macroeconomic factors including Federal Reserve policy and market liquidity will ultimately determine the speed of any advance.

Conclusion

Dogecoin appears well-positioned for further gains, with whale accumulation, ETF legitimacy, and constructive technicals aligning. Holding above $0.22 opens the path to $0.25 and potentially $0.30, with the longer-term $1 target remaining possible if buying momentum accelerates. As always with DOGE, disciplined risk management remains essential given the asset's inherent volatility.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah