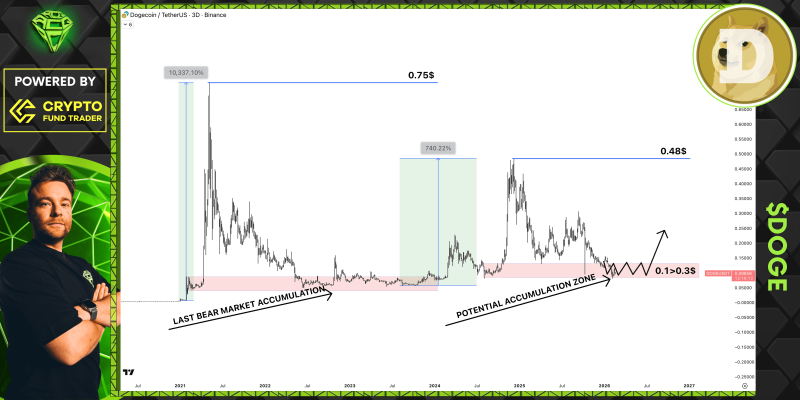

⬤ Dogecoin has settled into a prolonged sideways trading range that analysts are watching as a potential accumulation zone following previous cyclical peaks. The current price structure lacks clear breakout signals, but historical behavior suggests the strongest rallies often emerge from exactly these kinds of low-volatility, sideways environments. The 3-day chart of DOGE/USDT on Binance reveals how similar accumulation phases in past cycles led to massive percentage moves - with DOGE surging over 10,000% from earlier lows during previous bull runs.

⬤ Right now, DOGE is trading within a zone between roughly $0.10 and $0.30 that mirrors the last bear market accumulation base. During that previous period, DOGE lingered inside a comparable range for months before launching a powerful rally that eventually pushed the cryptocurrency toward $0.48 and ultimately peaked near $0.75. "The boring phases are where the foundation gets built," analysts note, pointing to how liquidity gradually accumulates while volatility contracts, setting up conditions for future directional moves once a catalyst appears.

⬤ The psychology behind these patterns centers on patience rather than immediate entry signals. While the current consolidation looks quiet and range-bound, participation is likely building behind the scenes as buyers and sellers test the lower boundary of the range. The marked potential accumulation zone suggests that once sufficient pressure builds up, a breakout could trigger quickly. What makes this development significant is that major moves in meme-linked assets like Dogecoin historically originate from extended periods of limited price action rather than actively trending markets.

⬤ If the accumulation pattern gets validated through subsequent volume increases or a decisive break above the range, it could signal a shift from sideways behavior into a new phase of trend expansion. Markets remaining calm for long stretches can pivot rapidly when sentiment and participation rise, potentially influencing broader altcoin dynamics. Continued observation of how DOGE responds near the lower range boundary will be crucial for understanding where the next directional chapter begins. For deeper analysis, see Dogecoin Price Outlook: Range Break Could Ignite Next Leg.

Usman Salis

Usman Salis

Usman Salis

Usman Salis