Coinbase (COIN) got hit hard as Compass Point downgraded the stock to "Sell" and slashed their price target from $330 to $248. The firm cited weak retail participation, falling subscription revenue, and rising crypto competition.

COIN Price Recovers Slightly After Brutal Week

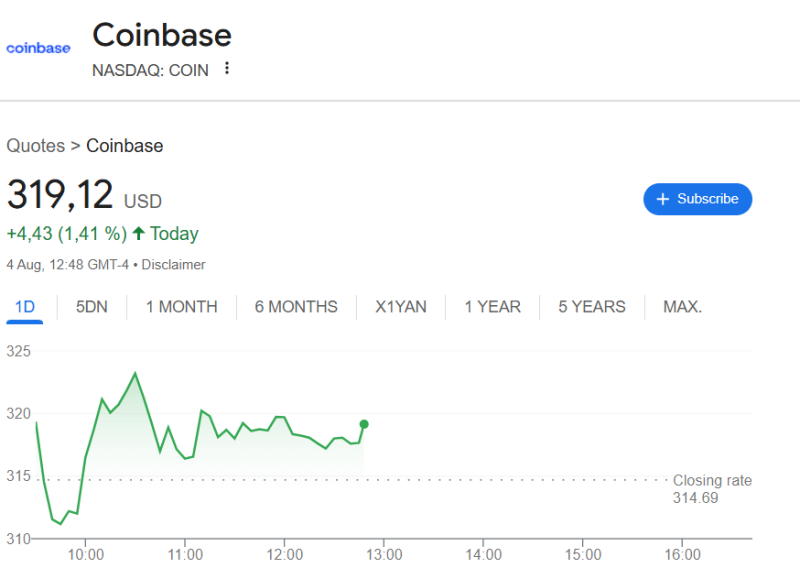

COIN price is trading at $319 on Monday, bouncing back modestly after an 18% plunge last week following earnings. Coinbase beat earnings expectations at $1.96 per share (vs $1.26 expected) but missed on revenue with $1.5 billion versus the $1.6 billion target.

The bigger issue is subscription revenue came in 8% below estimates - this is supposed to be Coinbase's reliable income stream. Their Q3 forecast is also 5% below consensus.

Coinbase (COIN) Price Faces Growing Headwinds

Compass Point expects "increasing stablecoin competition" to pressure COIN in the second half of 2025. Key revenue streams like Coinbase One are declining, and the crypto market isn't helping with Bitcoin and Ethereum struggling to gain momentum.

Despite these problems, COIN rallied 56% from May to July. Analysts think that's nuts, noting the stock trades at 44x EBITDA - way too expensive given the challenges ahead.

The firm doesn't expect the CLARITY Act to pass until 2026, meaning more regulatory uncertainty. Coinbase's stock trading plans probably won't move the needle since Robinhood already owns that space.

Bottom line: COIN's "premium valuation" is about to come crashing down, according to Compass Point.

Usman Salis

Usman Salis

Usman Salis

Usman Salis