The crypto market can be brutal, and Coinbase investors just got a harsh reminder. What started as a rough earnings report turned into a stock massacre, with COIN shares getting hammered in one of the worst weeks in months.

COIN Price Takes Massive Hit After Q2 Results

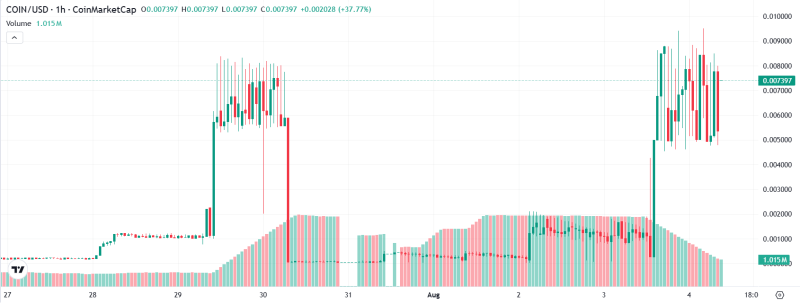

Coinbase (COIN) had one hell of a week, dropping 19.6% to $314.69 - its worst performance since September 2024. The carnage kicked off Thursday when they released Q2 earnings that were absolutely brutal.

Net operating earnings per share crashed 88.8% year-over-year to just 12 cents, while revenue of $1.5 billion missed FactSet's $1.59 billion estimate. EBITDA dropped to $512 million and transaction revenue - their bread and butter - slipped 39% from the previous quarter.

Smart Money Saw This Coinbase (COIN) Drop Coming

Here's the kicker - some folks actually called this mess beforehand. Crypto research firm 10x warned in late June that COIN's rally looked way too stretched. Their play? Short COIN, buy BTC. Nailed it. H.C. Wainwright was even more brutal, downgrading Coinbase from Buy straight to Sell last month, saying the rally had gotten way ahead of fundamentals.

Traders Rush for COIN Protection

The selloff has traders running scared. The put-call skew jumped to 2.6% on Friday - the highest since April 21. That means traders are paying a premium for downside protection, basically betting more pain is coming for COIN. When you see defensive positioning like that, it usually means the selloff isn't over yet.

Peter Smith

Peter Smith

Peter Smith

Peter Smith