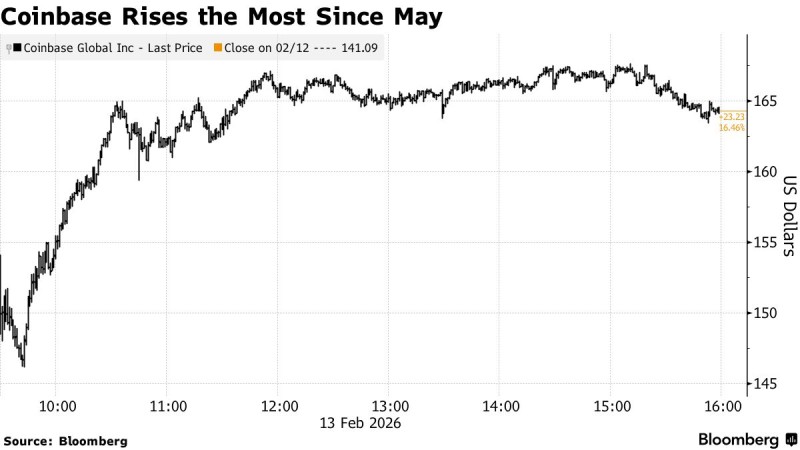

⬤ Coinbase shares jumped nearly 17% to around $164 even as the company posted disappointing quarterly results. Bitcoin climbed 5.5% to roughly $69,411 in tandem. According to Bloomberg's report, traders seemed to have already priced in worse news, triggering a relief rally on heavy volume.

⬤ The exchange reported Q4 revenue of $1.8 billion—down 20% year-over-year—and took a $667 million net loss after writing down crypto holdings. COIN had already slid 45% over the past year before Thursday's bounce. Similar patterns in crypto stock behavior show how quickly sentiment can flip when expectations get too negative.

"Investors appeared to position for a potential crypto market bottom," analysts noted, pointing to the disconnect between weak fundamentals and bullish price action.

⬤ Bitcoin's recovery played a major role. The leading cryptocurrency makes up 60% of the total crypto market cap and directly drives Coinbase's trading volumes. When BTC moves, COIN typically follows—a pattern explored in detail in this analysis of bitcoin-driven stock movements.

⬤ Why it matters: Coinbase acts as a proxy for the broader crypto market. When the stock rallies despite bad earnings, it signals investors are looking past current pain and betting on a cyclical turnaround. If Bitcoin continues climbing, COIN could see sustained momentum regardless of near-term fundamentals.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah