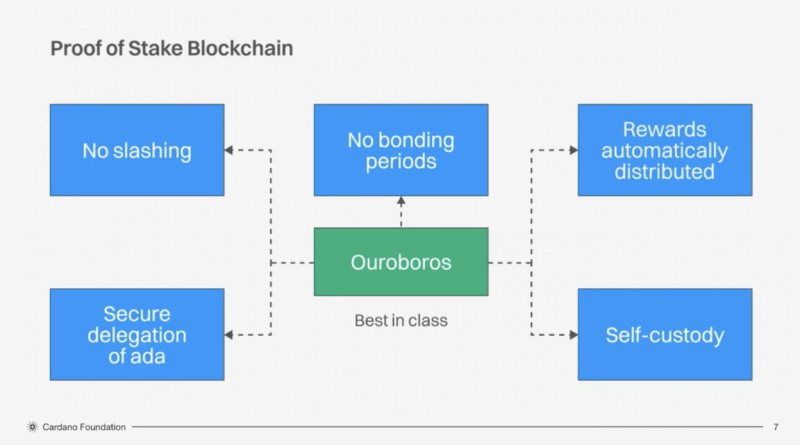

● What makes Cardano different from many competitors is its forgiving design. There are no slashing penalties if something goes wrong, and no mandatory lock-up periods that freeze your funds. This means you avoid forced commitments, potential losses from mistakes, or sudden liquidity problems. It lowers the barrier to entry and sidesteps the risks that have hit other networks—like projects collapsing or talent leaving due to overly strict staking rules.

● TapTools recently pointed out that Cardano's staking model stands out as best in class among blockchain platforms. Running on the Ouroboros proof-of-stake protocol, it gives users full liquidity, lets them keep custody of their assets, and allows secure delegation of ADA while earning rewards—all without giving up control.

● Financially, Cardano's approach makes sense. Rewards flow automatically to your wallet, and since you maintain self-custody, there are no hidden fees or inefficiencies from middlemen taking a cut. It's a cleaner model that shows staking can be both profitable and stable without creating unnecessary complications or depending on centralized custodians.

● Beyond blockchain, Cardano's design has broader implications. It encourages decentralization while supporting stake pool operators, creating real economic opportunities similar to traditional employment. This generates income and profit tax contributions that expand tax bases—potentially changing how regulators view staking and leading to clearer revenue recognition in national tax systems.

● By combining secure delegation, zero slashing risk, and automatic rewards, Cardano has made Ouroboros more than just a technical win. It's a financial model that balances ease of access, security, and decentralization—solidifying its position at the forefront of the blockchain space.

Peter Smith

Peter Smith

Peter Smith

Peter Smith