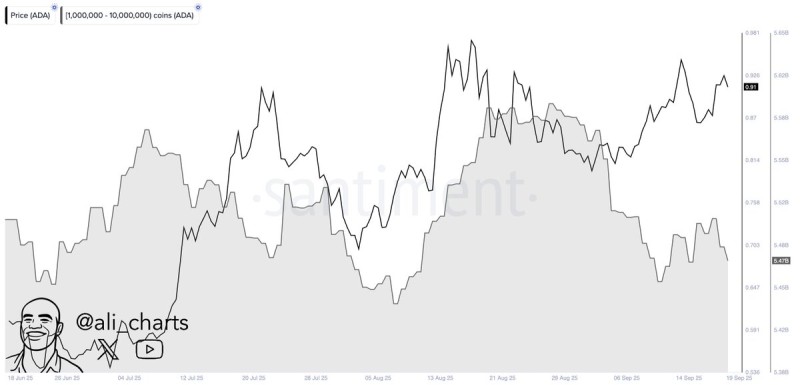

Something strange is happening with Cardano. While whales have been dumping massive amounts of ADA - over 530 million tokens in just two days - the price refuses to crash. Instead, it's sitting pretty near $0.91, almost like it's daring the market to push it lower.

The Great ADA Selloff

As Ali pointed out, this kind of disconnect between whale behavior and price action doesn't happen often, and when it does, it's worth paying attention.

The numbers are staggering. Addresses holding between 1 million and 10 million ADA have cut their positions by more than half a billion tokens. That's not just profit-taking - that's a coordinated exit by some of the biggest players in the game. Normally, this kind of whale activity would send prices tumbling, but ADA seems to have found buyers willing to absorb every token being sold.

This absorption suggests retail investors and smaller holders are stepping up in a big way. They're essentially catching the falling knives that whales are throwing, which could mean they see value where the big money doesn't.

Key levels to watch:

- Support: $0.88-$0.90 zone

- Resistance: $1.00 psychological level

- Breakout target: $1.20 if momentum continues

- Danger zone: $0.75 if support fails

ADA's journey from $0.65 lows to current levels around $0.91 has been impressive. The fact that it's holding these gains while whales are actively selling tells us demand is real. This isn't just a speculative pump - there's genuine buying interest across different market segments.

Why the Big Players Are Bailing

The whale exodus makes sense from several angles. After riding ADA from 65 cents to over 90 cents, taking profits is the smart play. The broader crypto market has been shaky, and macro uncertainty has everyone on edge. Plus, sometimes whales sell not because they've lost faith, but because they want to redistribute tokens to create a healthier ownership structure.

Peter Smith

Peter Smith

Peter Smith

Peter Smith